Australian investors don’t need to venture too far to take advantage of offshore growth opportunities and benefit from foreign currency earnings. Home grown success stories that operate overseas like Goodman Group, CSL, Orica, Brambles, Worley, Sonic Healthcare, and Aristocrat Leisure offer a certain level of diversification, but there are many other names, sectors and opportunities that Australian investors simply cannot get exposure to by investing locally.

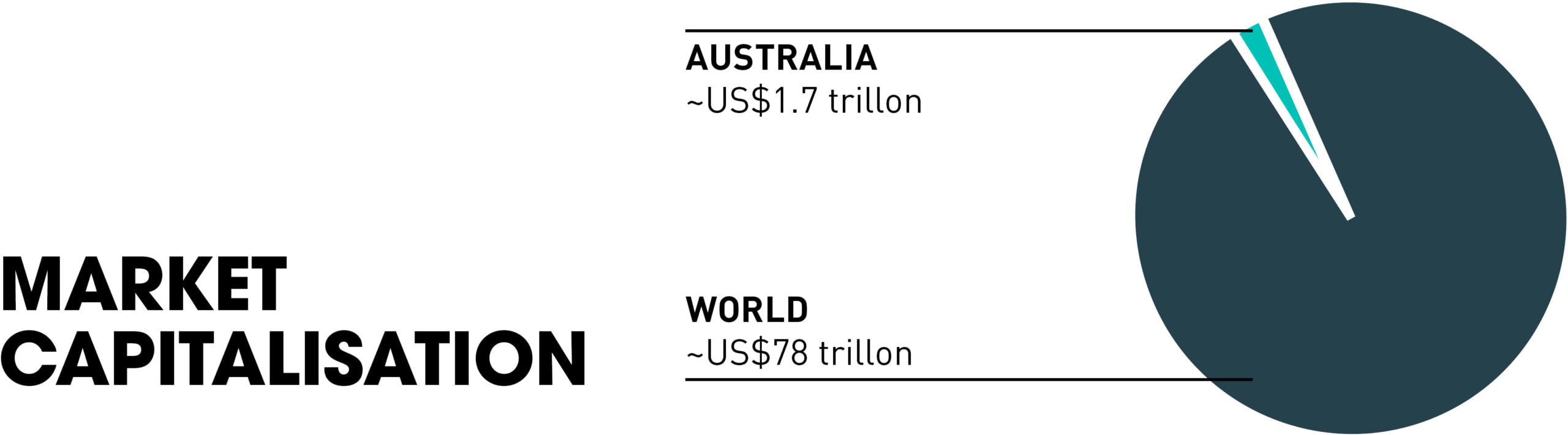

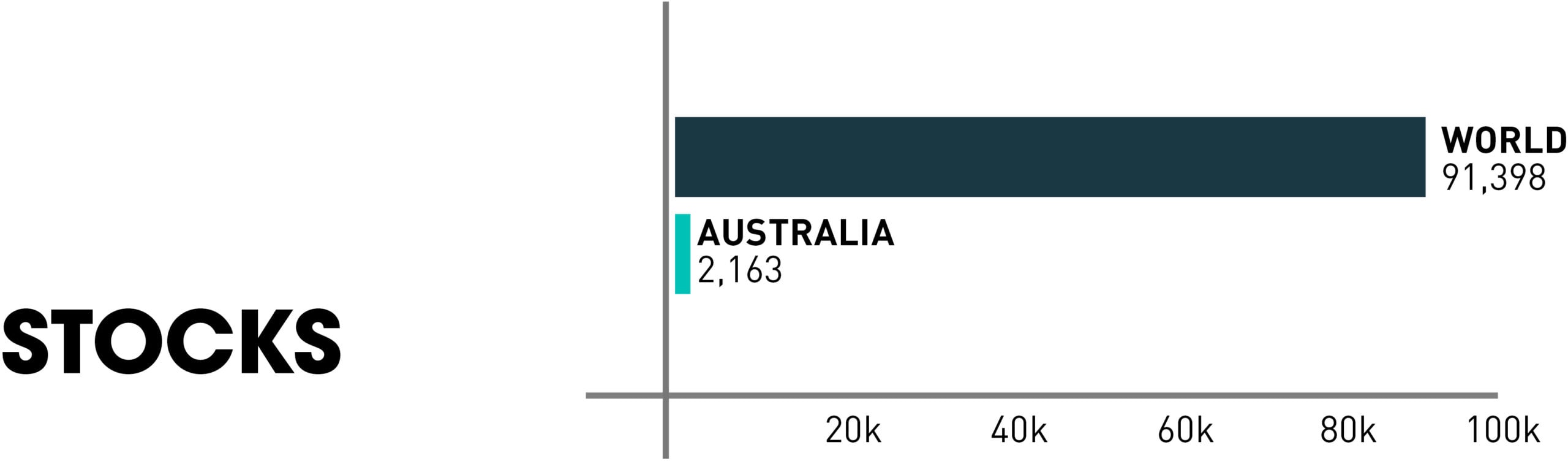

There are 60 major stock exchanges in the world and 91,398 active securities with a total value of ~US$78 trillion. The Australian share market is currently ranked 10th with a market capitalisation of A$2.4 trillion (US$1.7 trillon) and average daily turnover of over A$5 billion. While there are 2,163 stocks listed on the ASX within 11 sectors, most of the value is made up of the Top 200 stocks by market capitalisation (The S&P/ASX 200 Index).

However, the Aussie market represents only 2.2% of the total world share market and it is highly concentrated by industry, with Resources and Financials dominating over 47% of the Index by value. Local stocks are also comparatively smaller in terms of market capitalisation and liquidity.

International investing exposes you to the businesses and brands that feature in your daily life. Think about your phone (e.g. Apple or Samsung), credit card (e.g. MasterCard or Visa) or shopping (e.g. Amazon, Nike, Gucci). Global companies not only offer geographical and industrial diversification, but also tap into the next generation of technological advancements (e.g. NVIDIA, Microsoft, Oracle).

You can gain access to these renowned companies with the same ease and convenience as Australian shares, so what’s stopping you from owning a small part of these familiar brand names?

Learn more

We can help you invest in equity markets across all major global exchanges.

Our service incorporates tailored investment advice, online reporting, Citi and Morningstar research, flexible settlement options and broker sponsorship – all you need is an active domestic account to begin investing.

To learn more, contact your adviser directly or call us on 1300 0 BELLS (1300 023 557).