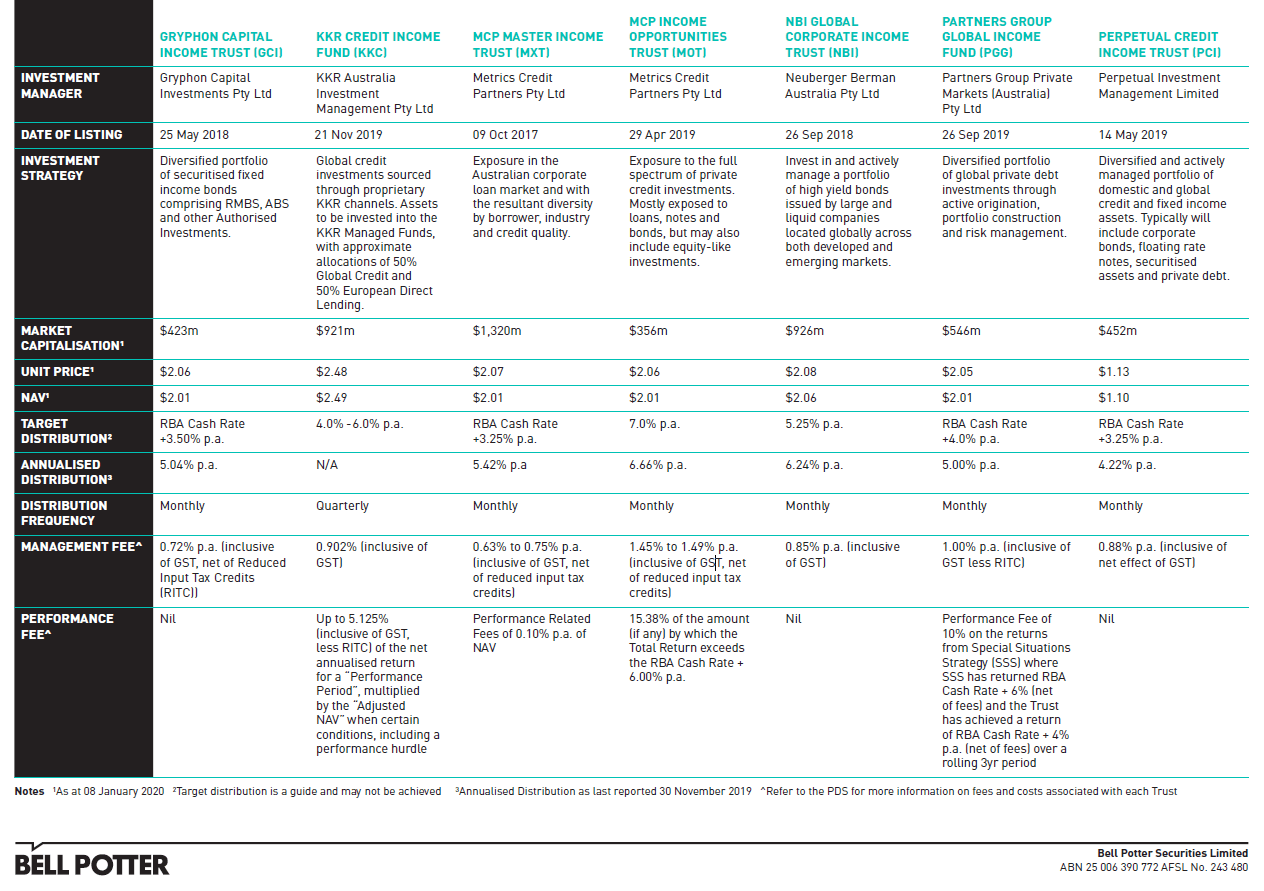

Listed Investment Trusts (LITs) provide investors with the opportunity to gain exposure to a diversified fund that trades on the ASX. LITs operate in a similar manner as a managed fund as they have an appointed manager who is responsible for the selection of investments and management of the LIT. The major difference between a LIT and a managed fund is that a LIT is a closed-end fund. Managers have a fixed amount of capital after the IPO, without the worry that large redemptions of units may negatively impact the investment portfolio in the future.

LITs can be used to provide investors with an opportunity to gain exposure to a portfolio of a wide range of various income assets including domestic and off-shore tradeable and non-tradeable debt securities, Asset Backed Securities (ABS), Residential Mortgage-Backed Securities (RMBS), as well as private loans.

TYPES OF DEBT INSTRUMENTS USED

High yield non-investment grade corporate bonds

The market of tradeable non-investment grade debt is in excess of $US2.7 trillion. Aiming to be robust and highly transparent, the market offers a broad diversification of sectors and companies.

Private Debt

Stricter regulatory capital requirements for banks globally has resulted in the reduction of bank lending and consequently the emergence of private loans. Senior secured loans form the majority of the private debt markets, ensuring first ranking of payment secured by the assets and cash flows of the borrower.

ABS and RMBS

An ABS is a type of fixed interest security in which the interest payments are linked to, and secured against, the performance of an underlying pool of assets. The assets consist of a pool of loans such as home loans, financing leases or credit card payments. RMBSs are a specific pool of loans secured against residential property.

KEY ADVANTAGES

- Broad range of mandates that allow managers access to invest in global credit and private credit markets, as well as the ability to originate loans

- LITs are closed-end funds that aren’t susceptible to large redemptions of units which may negatively impact performance

- Ability to access high yield debt that is generally not available to retail investors

- LITs consist of a diverse portfolio of domestic and global debt securities both tradeable and private loans

- Loans can be floating rate in order to mitigate against rising interest rates

KEY RISKS

- Underlying securities may be susceptible to adverse economic or regulatory conditions that negatively affect the sector and the companies in these portfolios, which may result in the default of the loan or worsening credit rating

- The investment strategy is not guaranteed to be successful, nor does it guarantee against the loss of capital

- LITs are not redeemable at the Net Asset Value (NAV), and may trade at a discount or premium to NAV

- Trading occurs on the ASX and is subject to having sufficient liquidity, which at times may not be present

- Key personnel from the investment manager may leave

- Past performance may not be an accurate indication of future performance, nor should it be relied upon when making an investment decision

LEARN MORE

If you’re interested in learning about these investment opportunities in the context of your portfolio, get in touch with your Bell Potter adviser. Alternatively, call 1300 023 557 to organise an obligation free discussion with one of our experienced advisers.