Results at a glance

SHV reported an underlying 1H23 EBITDA loss of -$55.6m. Key points below.

Operating results: Revenue of $60.9m was down -11% YOY (vs. BPe $85.3m). Operating EBITDA loss of -$55.6m compares to an EBITDA gain of $17.7m in 1H22 and our forecast loss of -$17.9m, with higher costs the main driver of the shortfall. 1H23 underlying EBITDA has been adjusted to reflect a component of crop losses for the typical half year recognition pattern.

Crop assumptions: 1H23 results are predicated on a crop of 17,500t (vs. BPe of 17,500t and guidance of ~17,500t) and an almond price assumption of A$7.45/Kg (vs. BPe at A$7.40/Kg and guidance at A$7.40-7.80/Kg which is unchanged).

Cashflow and balance sheet: Post lease operating cash outflow of $37.4m compares to an inflow of $4.2m in 1H22. Reported net debt of $189.9m compares to net debt of $134.5m at FY22 (and $125.8m at 1H22). SHV anticipates being operating cashflow positive in 2H23e.

Outlook: Key outlook comments include: (1) 2H23e Reported PBT is anticipated to be a smaller loss with crop adjustments reflected in 1H23; (2) the FY24 crop is expected to rebound with the benefit of lower fertiliser costs; and (3) SHV has initiated a number of projects with a target of a $20m+ uplift in profitability and a ~$30m cash benefit. To date SHV has generated an annualised run-rate of $4m and $8m, respectively.

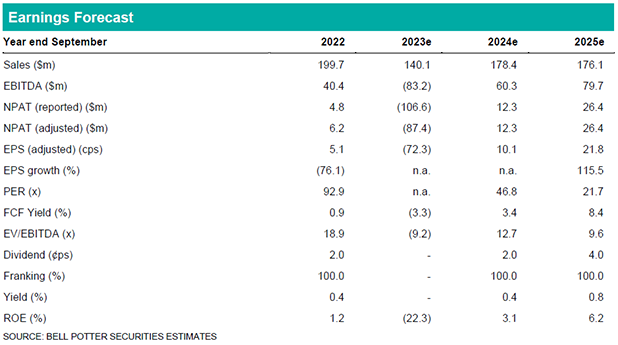

We have increased our forecast EBITDA loss in FY23e, while also reducing EBITDA by -17% in FY24e and -10% in FY25e. Our $5.50ps target price is unchanged after incorporating the benefits of the Horizon program in outward years.

Investment view: Buy rating unchanged

Our Buy rating remains unchanged. FY23e looks a write-off, however, cost pressures (i.e. fertiliser and ag-chem) have already demonstrated signs of peaking and Californian acreage signals imply a slowing in global supply growth in outward years that traditionally leads a firming almond price. SHV is also trading well below its market NAV (~$6.00ps).