IRCC approval of other English tests for the SDS in Canada

Immigration, Refugees and Citizenship Canada (IRCC) has announced the approval of several other English language tests (CAEL, PTE Academic, TOEFL iBT and CELPIP General) for the Student Direct Stream (SDS) visa program starting from 10 August 2023. Previously, only IELTS was accepted. SDS is an expedited study permit process for students applying to study in Canada from ~14 countries. In 2022 IRCC finalised ~739k study permit applications. We estimate that ~45% of these are via the SDS and the test is taken ~1.7x on average equating to ~500-600k IELTS exams p.a.

Changes to forecasts

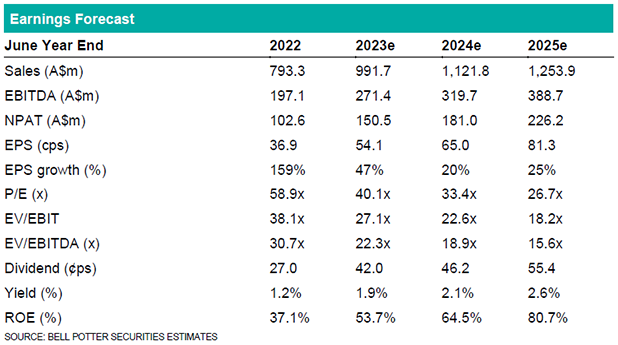

We revise our forecasts for this announcement, noting that our English language testing volumes were already conservative factoring in lost IELTS market share in both India and Canada. We assume market share losses of ~30% in this market or ~110k tests and an additional ~50k in other markets. The net result is flat IELTS volume growth in FY24e and 5% growth in FY25e. IDP has stated that the IRCC’s decision is not expected to have a material impact on the Company’s FY23 revenue or earnings so there is no change to our FY23e IELTS volumes. We have also slightly increased our opex in FY24 to account for higher expected marketing spend. The net result was EPS downgrades of -7.0% and -7.4% in FY24-25e. We have also modestly reduced our DPS forecasts by ~-4.3% in FY24e and FY25e.

Investment view: PT -8.7% to $27.40, Upgrade to Buy

We have updated each valuation used in the determination of our price target for the forecast changes as well as market movements and time creep. There are no changes to the multiple we apply in our EV/EBIT valuation of 29.1x or WACC of 8.0% in our DCF valuation. The net result is a -8.7% decrease in our PT to $27.40 which is a >15% premium to the current share price so we upgrade our recommendation to a Buy. Whilst this is not positive news for the Company, we had already factored in some market share losses and still anticipate strong growth in the student placement business driven by structural tailwinds and product innovation.