Strong quarter ahead of our expectations

Life360 reported 1Q2023 results that were ahead of our expectations on all key metrics: Paying circles up 73k q-o-q to 1.6m (vs BPe up 35k); Average revenue per paying circle of US$121 (vs BPe US$116); Annualised monthly revenue (excl. hardware) of US$239.5m (vs BPe US$235m); Global monthly users up 5% q-o-q to 50.8m (vs BPe 50.3m); Revenue up 34% y-o-y to US$68.1m; Adjusted EBITDA US$0.5m (positive figure achieved one quarter ahead of expectations); and Cash at 31 March of US$76.1m (vs BPe US$70 75m). The company reiterated its 2023 guidance. Operating cash flow in Q1 was an outflow of US$(9.2)m but this was expected and the company reiterated it expects to be operating cash flow positive from Q2 onwards.

Upgrade in 2023 forecasts to above guidance

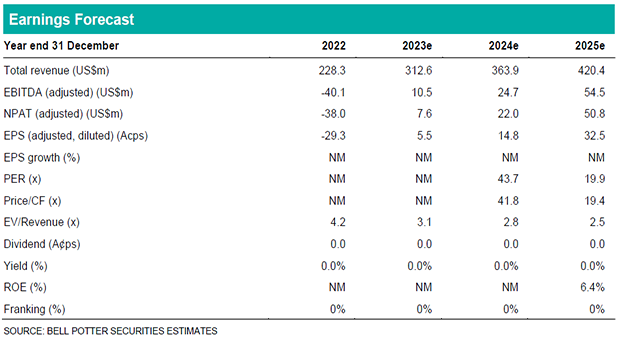

We have upgraded our 2023 revenue and adjusted EBITDA forecasts by 2% and 42% to US$312.6m and US$10.5m. Notably our forecasts are now ahead of the guidance of US$300-310m for revenue and US$5-10m for adjusted EBITDA. We now see potential for an upgrade to the guidance later in the year. There is little change, however, in our 2024 and 2025 forecasts which already assume strong growth. We continue to forecast mid to high teens percentage growth in revenue in 2024 and 2025 and at least a doubling of adjusted EBITDA in each period.

Investment view: PT up 3% to $9.00; Maintain BUY

We have updated each valuation used in the determination of our price target for the forecast changes as well as market movements, exchange rate changes and time creep. There are no changes in the key assumptions we apply which are a 3.0x multiple in the EV/Revenue and 9.4% WACC and 5.0% terminal growth rate in the DCF. The net result is a 3% increase in our PT to $9.00 which is >15% premium to the share price so we maintain our BUY recommendation. The next potential catalyst is the release of the Q2/H1 results in September where despite a likely decrease in paying circle growth in Q2 – due to the Android price increases – we expect another good quarter and importantly positive operating cash flow.