FY23 NPAT expected to be $30m, from $37.4m

The company announced lower guidance for FY23 NPAT to approximately $30.0m, which compares to previous guidance of meeting or exceeding FY22 NPAT of $37.4m. This was attributed to weather conditions and supply chain constraints which have delayed settlements from Q4 FY23 into FY24. The statement highlights that enquiry levels and sales rates have strengthened in H2 FY23 compared to H1, and that sales in the three months to end May 2023 are the strongest seen since Apr 2022. New home sales appear to have slowed in June, as the RBA increased rates, and continue to be impacted by cost-of-living pressures, weak consumer confidence and the elevated risk of builder insolvencies. The sale of the Williams Landing shopping centre is now anticipated in FY24, which will impact FY23 gearing and any profit on sale will not contribute to FY23 earnings.

Investment view: BUY, Valuation A$5.20 per share

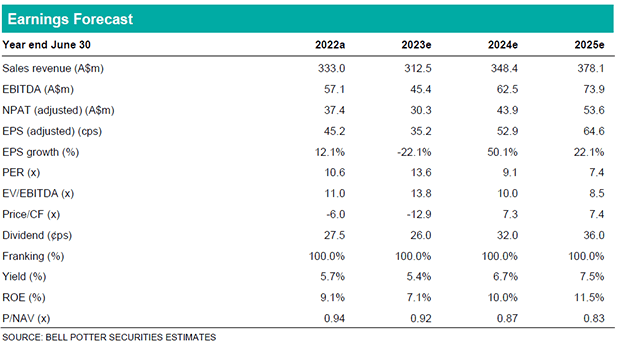

This is slightly disappointing news from the company, although needs to be put in context. We see this as a delay to settlement, rather than a cancellation of sales, and we could expect the shortfall in settlements from FY23 to appear in FY24, (which would otherwise imply to an upgrade to our FY24 forecasts). To maintain conservatism in our forecasts we are leaving our FY24 estimates little changed. As a result, our EPS forecast reduces by 20.1% for 2023, 1.2% for 2024, and 3.5% for 2025. Our DCF valuation decreases to $5.19 from $5.39 and we round our price target to $5.20 ($5.40 previously). CWP shares have performed well in CY23 to date (rising 10.8% from $4.33 at 31 December), but continue to trade at an undemanding 9.1x FY24e EPS, or a 12% discount to FY24e NTA (of $5.50 per share). The potential for improving sales as the interest rate cycle peaks, combined with an undemanding valuation means we maintain our BUY recommendation. The company are due to report FY23 earnings on 23 August.