Continued challenges in commercial wine channels

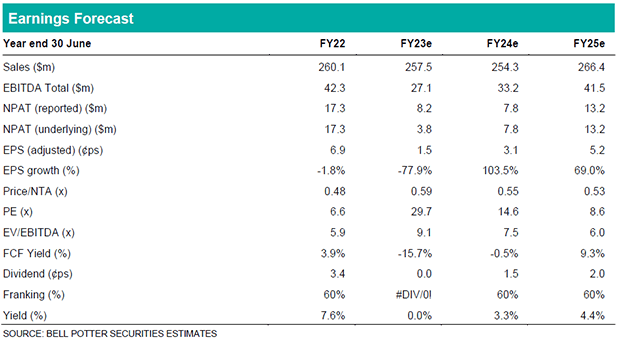

At headline level AVG’s FY23e revenue and EBITDAS guidance were broadly in-line with BPe expectations. Group revenue in FY23e (subject to FX) is expected to fall in the range of $255-260m (vs. $260.1m FY22 and BPe prev. $262.3m), whilst underlying EBITDAS guidance is for $26-28m (vs. $43.7m FY22 and BPe prev. $27.6m). However, we note abovementioned guidance excludes the impact of a $9m fixed cost write off taken below the line which was necessitated by the magnitude of a lower 2023 vintage. AVG’s net debt position at FY23e is forecast to be $52-57m and compares to BPe prev. $51.5m.

With growing conditions having worsened during key yield development months earlier this year, AVG’s company owned and leased crush came in materially below previous guidance at ~80kt (prev. 96k), representing a ~20% yield decline vs. 2022 (although we note this compares to anecdotal reports from smaller Riverland growers of -30-50% YOY). At this stage the company expects EBITDAS to improve in FY24e to be “directionally” in-line with FY22 (i.e. $43.7m).

Outlook comments include: (1) AVG continues to win market share in premium product segments; (2) declining off-trade consumption trends in commercial wine segments and UK hyperinflation continue to offset branding progress; (3) AVG is targeting $9m cost out in FY24e; (4) a focus on reducing net debt, suspending the FY23e dividend and future dividends until ND/EBITDA (pre-AASB 16) is below 2x (currently ~3x); and (5) AVG flagged potential further asset sales to release value.

Investment view: Maintain Hold recommendation

Our EPS changes are -10-20% off a low base across FY23-25e. AVG continues to shift its product mix up the value curve, with growth in higher value no and low alcohol categories sales (+44% in 1H23) continuing to effectively offset the company’s top-line despite losses in commercial channels (McGuigan -11% in 1H23). However, whilst commercial wine for the meantime still represents the majority of the product portfolio (~65%), the delta on these lost volumes is likely to continue to have a greater absolute (negative) impact on earnings. We retain our Hold recommendation.