Transfer of coverage; positive view maintained

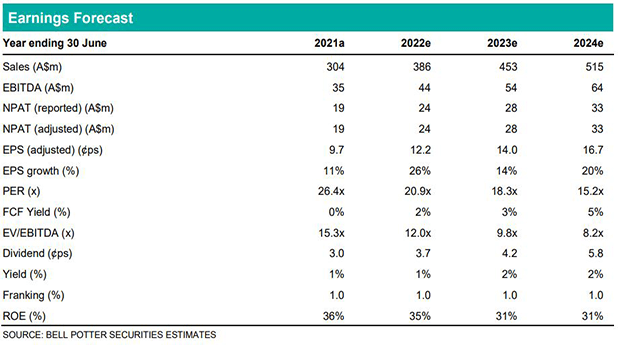

We have transferred analyst coverage of MAD, with our investment thesis unchanged. Our Hold recommendation is underpinned by a favourable medium-term outlook, recognising MAD’s mature and profitable Australian operations and fast-growing North American business. We also recognise that MAD stands to benefit from further diversification of earnings streams, with respect to geography, services provided, customer base and commodity exposure, as the company executes its international growth strategy and expands its service offerings to existing customers. We see MAD’s strong balance sheet supporting its organic growth ambitions in addition to paying a recurring dividend. However, we view MAD’s FY23e P/E of 18.3x as fair value, and therefore maintain our Hold recommendation. To reflect higher operational and interest costs we have downgraded our EPS forecast by -3% in FY22e; -9% in FY23e; and -9% in FY24e.

We expect MAD can meet its FY22e guidance for revenue of >$370m (BPe $386m) and NPAT of >$24.0m (BPe $24.4m). MAD’s annualised Q3 FY22 revenue run-rate was $392m and we expect a continuation of record quarterly revenue performance into Q4 FY22e, supported by strong demand for heavy mobile equipment maintenance services. Despite mounting cost pressures in the Australian mining industry, we see MAD’s revenue outperformance supporting its NPAT outlook.

Investment thesis: Hold, TP$2.65/sh (prev. $3.10/sh)

We continue to forecast a strong medium-term earnings outlook for MAD, however, we believe the company is fairly valued at the current share price. This earnings outlook is underpinned by ongoing expansion of MAD’s core service offerings into new, large markets, including the United States’ mining and energy sectors and Canada. These growth opportunities complement the company’s mature Australian business, where management have demonstrated a track record of consistent annual revenue growth and stable margins in recent years. The company’s balance sheet is capable of funding its growth ambitions and supporting future dividends within its stated policy.