Moving parts warrant a more cautious outlook

We have reviewed commodity drivers, milk flows and farmgate pricing (FMP) below:

Commodity returns: Commodity returns stabilised and lifted after weakening in May. Implied SMP returns have lifted to ~A101¢/L in Jun’22, up +39% YOY. Considering forward rates, 1Q23e SMP returns are averaging ~A99¢/L, up +27% YOY and broadly comparable to 2H22 averages of A100¢/L.

Local milk production: SE Australia milk production YTD has contracted -1% YOY to Apr’22, with Murray catchment milk production was down -6.3% YOY. Domestic milk flows YTD have been biased towards cheese production (up +30% YOY) and more recently SMP (from down -7% YOY in 1H22 to down -4% through to Mar’22).

Global trade flows: Production in Mar’22 across the top 5 exporters (EU, US, NZ, Australia and Argentina) was down -1% YOY and YTD is down -1% YOY. Production declines have been observed in all regions outside of Argentina. Imports of SMP into China were up down -32% YOY in Dec’21 and down -20% YOY on a R3M basis.

Farmgate pricing: Southern FMP’s have lifted materially and while we had allowed for an additional step-up from the $8.40/KgMS open (to $8.60/KgMS), however, the uplift has been more material to ~$8.96/KgMS (vs. peers at $8.80-9.50/KgMS).

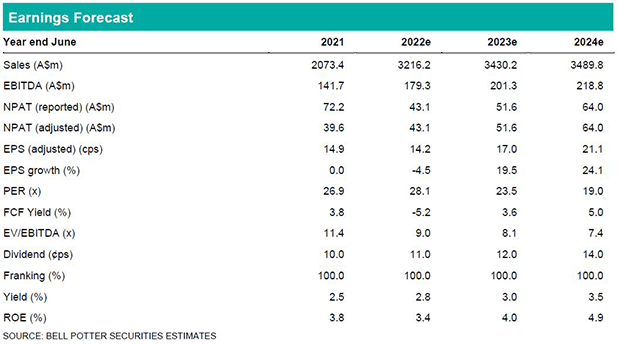

We have increased our FMP assumption, with modest price recovery in the branded portfolio. The net effect is NPAT downgrades of -30% in FY23e and -26% in FY24e. Our target price falls to $4.20ps (prev. $5.90ps) following these changes and a modestly higher WACC assumption, reflecting global the peer group de-rating (~10%).

Investment view: Downgrade to Hold

We downgrade our rating from Buy to Hold. The opening FMP was high but manageable in the context of global commodity returns, however, subsequent step-ups look difficult to make up in the absence of further retail shelf price gains, which given recent retailer private label price freeze announcements is less certain. Outside of corporate activity, the catalyst for a re-rating is becoming less clear.