First sales and Peak Project Funding

On 23 June 2022 MCR announced that it had received its first payment from nickel concentrate sales for FY22 of 1,003t (vs 962 BPe). Net proceeds (sales revenue less processing and freight charges) of A$25m were received. MCR also announced Peak funding (growth capital and working capital) pre-sales was A$98m, (previously forecast of A$107m). Major capital works are now complete (excluding the new camp, A$15m).

FY23 production forecasts

MCR is expected to begin providing periodic production and cost guidance (September 2022). In advance of guidance, we have updated our production scenario to reflect a more conservative ramp-up towards name-plate production in 4QFY23, resulting in reduced forecast FY23 production of 450kt, or ~ 75% of name-plate production (600ktpa). Our forecast of 600ktpa was based on our interpretation of the Definitive Feasibility Study (DFS) results. We will again review this assumption when guidance is announced.

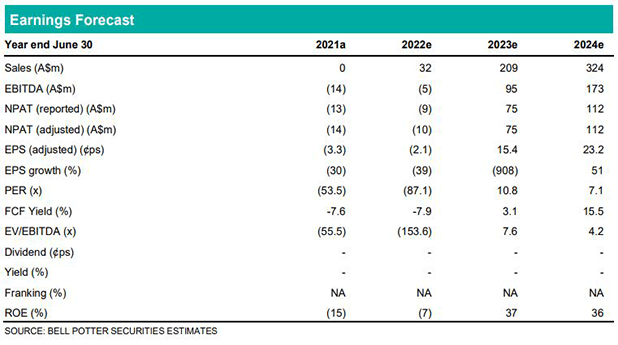

Investment thesis – Buy, TP$2.00/sh (from Hold, $2.35/sh)

With this update we decrease our valuation by 15% to $2.00/sh, after blending our forecast nickel price ($1.82/sh) and spot nickel valuations ($2.40/sh), 70:30 respectively. Our decreased target price is mainly due to the reduced spot nickel price. MCR is supported by the ‘decarbonisation’ thematic, with nickel an important component (with lithium) of high-energy-density NCM batteries. Amongst the remaining mid-tier Australian nickel sulphide miners, MCR is well positioned to benefit from demand for nickel, given near-term production, existing Resources and its highly prospective exploration portfolio. With this update and the commencement of operating cash flows, we remove our Speculative risk rating and upgrade to Buy (from Speculative Hold). EPS changes in this report include: FY22 -20%; FY23 -48%; and FY24 +19%, driven by the changes to our production ramp-up assumptions, and specifically our assumption of 75% of name-plate in FY23.