YTD pricing trends look reasonable

Our analysis of YTD wholesale, retail and export pricing suggests reasonable pricing outcomes across most categories, with key takeaways being:

Export citrus markets: At this stage of year there are modest export volumes exiting Australia (CGC highlighted in its May AGM update that only ~1% of the crop had been harvested). However, landed pricing trends in export destinations of Japan and China have been generally favourable YTD. YTD landed mandarin prices in China are up +17% YOY and orange prices landed in Japan are up +19% YOY. In addition we are seeing favourable fresh grape export prices, YTD up +8% YOY ex-Australia.

International blueberries: Through 1Q22 we witnessed Moroccan blueberry prices up +2% YOY in Euro terms, though we note the fade in Mar’22. At its AGM, CGC highlighted: (1) China has performed well with record production volumes, with late season pricing off as tier one cities were impacted by lockdowns; and (2) that Morocco saw favourable pricing across 1Q22 and then faded in 2Q22.

Avocado pricing: One of the largest swing variables in expectations for FY22e is the price for Avocados. May’22 pricing of QLD avocados in wholesale channels was up +$1.70/tray YOY in VIC and up +$7.40/tray YOY in NSW. Retail pricing has also demonstrated YOY gains the past five weeks, up on average +18% YOY over this time frame, a period that typically coincides with CGC harvest volumes commencing.

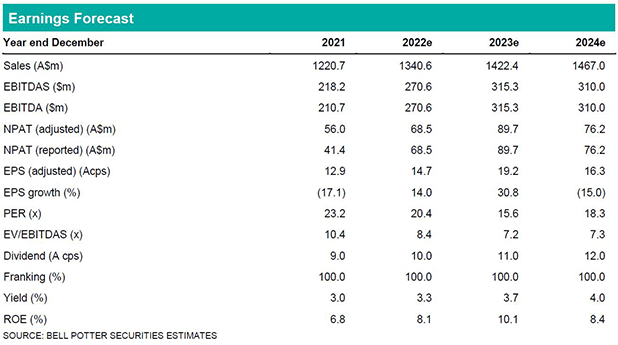

We have adjusted our interest rate assumptions in FY23-24e resulting in NPAT downgrades of 3% in CY23e and 5% in CY24e. Our target price is moderated to $3.75ps (prev. $3.90ps) reflecting a higher discount rate assumption in line with the changing macro environment.

Investment view: Buy rating retained

Our Buy rating remains unchanged. CGC has deployed ~$540m of capital since CY19 through the acquisition of citrus properties, development of berry acreage in Morocco and China and investment in mushroom and tomato capacity. A return on this investment is expected to be the main driver of earnings through to CY23e.