Transfer of coverage – Buy for valuation re-rating

We resume coverage of RMC with a Buy rating following a change of analyst. RMC is a non-bank lender focussing on standard and specialised mortgages with a capital lite growth model, able to fund and distribute mortgages. It is relatively small, but profitable and paying dividends. Its market share has increased from 0.6% in 2019 to 0.7% today, but this small increase has resulted in a 44% increase in balance sheet assets and a 179% increase in profitability. Over a four-year period to FY 21, net interest income (NII) reached $242.7m, a CAGR of 33% and NPAT reached $104.0m, a CAGR of 58%.

But at this moment the company faces some risks. The Australian property market has shown strong price appreciation, and interest rates are rising rapidly. This is likely to lead to lower property values and increasing cost of servicing mortgage debt, which should lead to higher defaults. Set against this risk, average LVRs are low (sub 65%), LMI (insurance) is in place for prime loans (>80% LVR at outset), unemployment remains very low at just 4% with structural labour shortages, and while the economy will slow, we believe a deep recession is unlikely.

Investment View: target price $2.15/ share

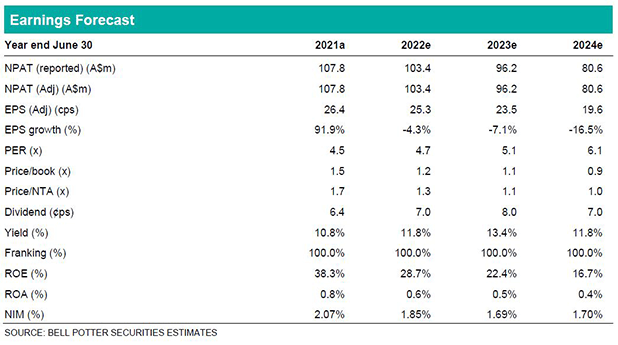

Despite the strong revenue and profitability growth that the company has, and continues to generate, it’s shares have been de-rated from a high of $2.73 (Feb 2021) to just $1.19, representing just 4.7 times 2022 prospective earnings. In this note we consider what sort of conditions could justify such a low valuation and estimate that to justify the current share price, the company would have to write off around 3% of mortgage assets, or c.$560m. To put this in context when Covid-19 struck and 10% of the book was put on hardship payment moratoriums, it took a collective provision of just $16m (from which minimal write-offs have materialised). To get a valuation close to the current share price implies a scenario that we regard as both extreme and unlikely. Our target price is $2.15 per share, set using a NPV of future profitability as a proxy for a DCF valuation. The next news event is the 2022 full year results in August.