Expecting $3.11bn cash earnings, 59¢ interim dividend

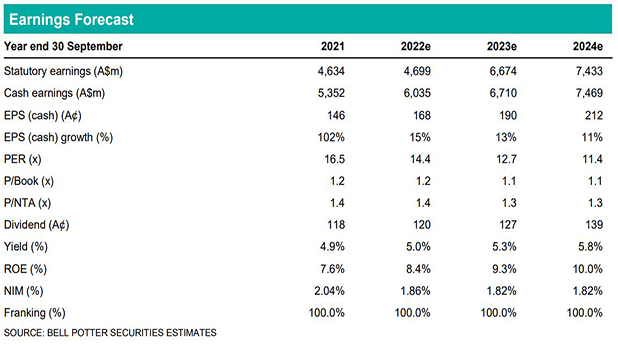

WBC will release its 1H22 result on Monday 9 May. Our forecasts are: 1) statutory earnings $3.09bn; 2) statutory EPS 84¢; 3) cash earnings $3.11bn; 4) cash EPS 85¢; 5) cash earnings ex-notable items $3.64bn; 6) cash EPS ex-notable items 99¢; 7) fully franked interim dividend 59¢, cash payout 70%; 8) cash ROE 8.6%; 9) group NIM 1.86%; 10) credit impairment charge $0.26bn/7bp GLA; 11) CIR 54%; and 12) level 2 CET1 ratio 11.8%.

We expect cash earnings of $3.11bn in 1H22e. This compares with $1.82bn in 2H21 (the miss being revenue shortfalls – i.e. largely lower Consumer other banking income – and higher overall operating expenses including a slew of one-off expenses) and $3.54bn in 1H21. The negative trend should then reverse and the 1H22e number appears to be in line with the 1Q22 cash earnings of $1.58bn. WBC’s balance sheet remains strong with a Level 2 CET1 ratio of 11.8% (vs. APRA’s new benchmark of 10.25%), down from 12.2% previously. The rest of the ratios also remain adequate with LCR over 142%, NSFR around 127% and the deposits to net loans ratio close to 84%.

Price target now $25.00 but maintain Hold rating

We have decreased cash earnings as follows: 1) FY22e nil; 2) FY23e -6%; 3) FY24e – 8%; and 4) FY25e -8%. This is due to: 1) lower other income (up to 2% lower); and 2) higher operating expenses (up to 5% higher, the change being expenses at around $9.5bn in FY24e compared to $9.0bn previously). On the other hand and based on lower overall risk metrics, we have cut the discount rate by 0.25% to 10.00% and the dividend sustainable yield by 0.50% to 4.00%. The net impact is therefore a small increase in the valuation and price target from $24.00 to $25.00 per share, all else being equal. Based on a 12-month Total Shareholder Return of less than 15%, we continue to rate WBC as a Hold.