Upgrading our coal price outlook

We have marked to market coal prices for the March 2022 quarter and upgraded our met coal price outlook (premium Hard Coking Coal) to average US$384/t in 2022 (previously US$250/t) and US$238/t in 2023 (previously US$163/t). Current spot HCC prices are US$513/t (Fastmarkets). Record met and thermal coal prices have been driven by the global disruption of trade flows, seasonal supply weakness, labour shortages, lack of investment in new supply and strong demand from infrastructure led economic stimulus.

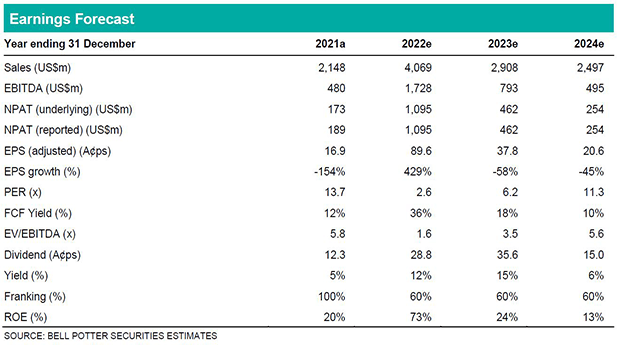

EPS changes in this report are: CY22 +146%, CY23 +256%; and CY24 now A20.6cps (previously A2.2cps).

Quarterly preview: Production risks & inflation

We expect stronger March 2022 quarterly production with the prior quarter impacted by weather events in the Bowen basin and a shutdown at the Curragh mine. However, above average rainfall has continued into early 2022 and remains a risk production and coal logistics chain performance. We also see risks to CRN’s unit cost outlook with well-documented inflation noted by peers across the mining industry.

Investment view: Buy, TP $2.55/sh (previously $1.65/sh)

The speed of CRN’s recent balance sheet repair has been remarkable. While we expect operating and capital costs to be elevated over the forecast period, on our met coal price outlook the company will generate exceptionally strong free cash flow. In the absence of acquisitions or major project developments, CRN is likely to return surplus funds to shareholders as evidenced by our strong dividend yield outlook. We maintain our Buy recommendation on near-term yield and commodity price support.