FY23 Result and changes to forecasts

A2M reported FY23 underlying NPAT ahead of our expectations at NZ$155.6m. Key operating statistics of the result included:

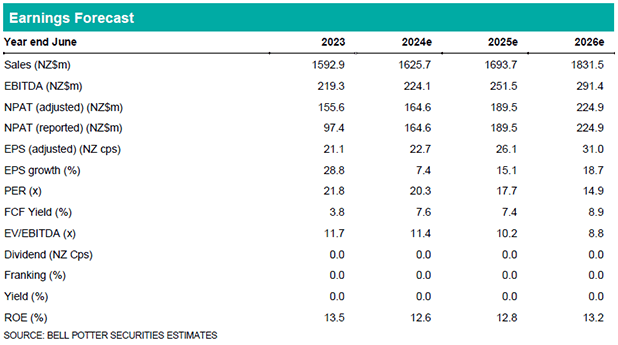

Operating results: Revenue of NZ$1,593m was up +10% YOY (vs. BPe NZ$1,587m). EBITDA of NZ$219.3m was up +12% YOY (vs BPe of NZ$215.4m). EBITDA ex-MVM was NZ$245.8m (vs. BPe of NZ$234.3m). Underlying NPAT of NZ$155.6m was up +27% YOY (vs. BPe of $147.5m).

Infant formula drivers: China distribution points contracted -2% YOY to 25,900, and sequentially were down -3% HOH. China direct IMF sales reached NZ$945.6m (+36% YOY) and represented 90% of total 2H23 IMF sales (67% in FY22 and 80% at 1H23). Marketing expenditure of NZ$260.2m (vs. BPe of NZ$274.9m) was up +14% YOY.

Cashflow and balance sheet: A lease adjusted operating cashflow of NZ$107.7m compares to NZ$199.7m inflow in FY23 (and BPe of NZ$102.5m), and reflects a NZ$103.1m working capital investment ahead of China regulatory changes. Net cash exited the period at NZ$700.7m (BPe NZ$695.2m) and compares to FY22 at NZ$763.0m and reflects the impact of a NZ$149.1m share buyback.

FY24e outlook: A2M expects: (1) low single digit revenue growth in FY24e with EBITDA margins broadly consistent with FY24e levels with higher levels of cash conversion; and (2) A2M has retained its medium term target EBITDA of “teens”, while stating it is unlikely they can reach the “low-to-mid 20’s” in the foreseeable future.

Following the result we have downgraded our NPAT forecasts by -6% in FY24e and FY25e. Our target price is reduced to A$4.85ps (prev. A$5.70ps).

Investment view: Hold rating unchanged

We expect 1H24 to be challenging given the China label transition and likely disruption as brands exit the market (~35% are yet to receive SAMR approval). However, A2M has grown share in all key measures in a declining market and is well positioned to benefit from China market brand consolidation, stabilising birth rates, and the return of overseas travellers and students to Australia.