Record quarter

Envirosuite provided a 4QFY23 sales update which was a record in terms of quarter sales and the key points were: 1. Sales up 13% to $6.8m comprising new ARR of $3.1m and project sales of $3.7m; 2. Total ARR up 12% to $59.4m (vs BPe $59.0m); and 3. Annualised churn of 8.1% but includes one-off churn event in Q3 (1.9% excluding one-off impact). The company also reaffirmed its target of “transitioning to adjusted EBITDA profitability in FY23” and added that it “enters FY24 with a strong pipeline, upward momentum across the product portfolios and regions, and rapidly growing interest from major corporate and industry participants”. On the conference call CFO Justin Owen added that the cash position at 30 June was >$8m which was slightly ahead of our forecast of $7.7m.

Modest downgrades

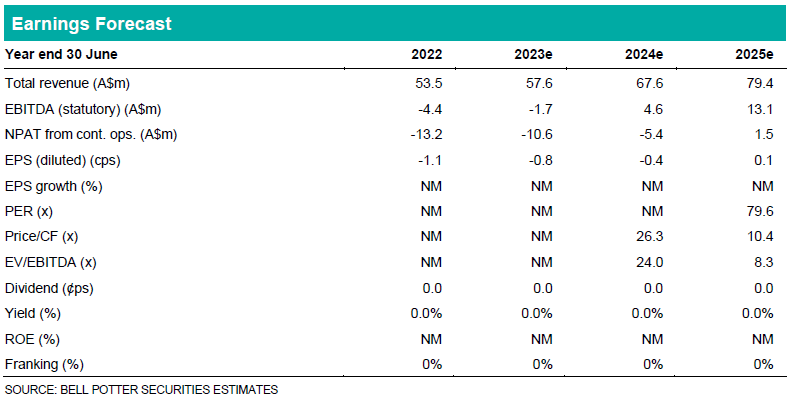

We have modestly downgraded our revenue forecasts in FY23, FY24 and FY25 by 1%, 2% and 3% mainly for conservatism despite the slightly better than expected Q4 sales result. The downgrades are driven by reductions in our recurring rather than non-recurring forecasts. The revenue downgrades have had a similar percentage impact on our statutory and adjusted EBITDA forecasts but there is a larger impact at NPAT/EPS due to the lack of change in our D&A and net interest expense forecasts. We have, however, modestly increased our forecast cash position at 30 June 2023 to $8.1m given the comment on the call that it is >$8m.

Investment view: $0.20 PT unchanged, Maintain BUY

We have upgraded each valuation used in the determination of our price target for the earnings changes as well as market movements and time creep. There are no changes in the key assumptions we apply which are a 2.5x multiple in the EV/Revenue

and a 9.1% WACC and 4.5% terminal growth rate. The net result is no change in our PT of $0.20 which is >100% premium to the share price so we maintain our BUY recommendation. Potential catalysts include the upcoming FY23 result (e.g. potential positive adjusted EBITDA in H2) and the FY24 outlook (e.g. positive free cash flow).