FY23 Result

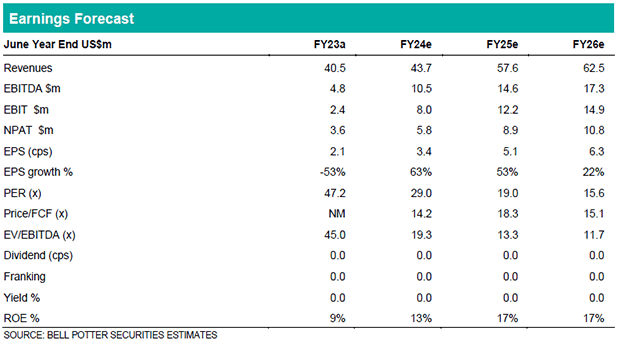

All figures in US$m. Key financial results were largely ahead of guidance released in May 2023 and our previous forecasts. Revenue $40.5m (10% decrease YoY, FY22 $45.0m), EBITDA $5.3m and NPAT $3.6m. Significant decrease in contribution margin to 52.5% (FY22 59.3%) and profitability with EBITDA margin of 13.1% (FY22 28.9%) and EBIT margin of 6.7% (FY22 23.8%). FY23 performance has been impacted by clinical trial patient enrolment delays, higher staffing costs prior to the restructure in May 2023 and decrease in high margin licensing mix (historically ~ 17%-19%). Clinical Trials sales contracts of $34.0m executed during FY23 were below recent years performance (FY20 $46.0m, FY21 $47.3m, FY22 $82.5m). Future contracted backlog decreased from $139.1m at the end of FY22 to $132.6m at the end of FY23. Net cash balance of $27.8m as at 30 June 2023.

Alzheimer’s Disease momentum

The company has indicated that momentum is starting to build following the significant developments with the first FDA traditional approval announced in July 2023 (lecanemab) with donanemab expected to follow later this year. The Cogstate customer base is already expanding with 3 new large pharma customers in FY24 and additional clinical trial engagement expected from the current network. Clinical trial enrolment delays experienced during FY23 have been resolved and these revenues are now expected to be recognised over FY24/25. Launch of Cognigram within the US market is targeted by late CY23 or early CY24 to support the commercialisation of new therapies (lecanemab/donanemab).

Investment View: Hold, Price Target $1.60

We maintain our Hold recommendation with price target of $1.60. Whilst we recognise that Cogstate is well positioned to capitalise on momentum in the Alzheimer’s Disease sector, we have downgraded revenue/earnings across FY24/25/26. This takes into account further potential patient enrolment delays and macroeconomic headwinds with respect to the availability of capital for R&D amongst biotech companies.