2Q24 at a glance

TSK reported a 2Q24 update outlining continued strong momentum regarding client wins, deployments and cash flows. These included: (1) expansion into the Taiwan market via the Plexure division, a significant market for McDonalds in Asia; (2) implementation of its solution into Retail Food Group’s (RFG, Buy rated) Crust business via the TASK division following deployments in Q1; and (3) further contract wins across North America and Australia. TSK generated NZ$12m in operating cash flows for the quarter (with the benefit of upfront annual payments within Plexure), following a NZ$5.9m cash outflow in Q1, to end the period with NZ$31m.

Payments processing progressing

TSK acquired payments software IP in Apr ’23 with the aim to develop and integrate the solution within its own suite and extend its end-to-end capabilities further; the rationale being a payments capability would create a key competitive advantage via reduction in suppliers a customer is exposed to and further value-added service delivery. TSK views the opportunity as representing an “attractive revenue stream” and anticipates commercialisation of the platform over the next ~6-12 months.

The payments solution is now certified in NZ and ~70% complete in Australia, with certification having commenced in USA to be followed by Europe and Asia.

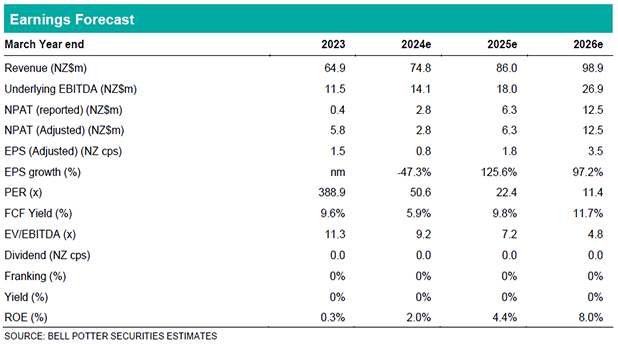

Investment view: Buy, Target Price $0.57/sh (prev. $0.62/sh)

We maintain our Buy recommendation and make no changes to our estimates, however we reduce our EV/EBITDA multiple in line with its cohort which affects a reduction in our Target Price to $0.57/sh. While exposed to the consumer, TASK operates on an enterprise licensing model and not on a per-transaction basis. Plexure revenue largely relates to traffic on its GMA-lite platform. Our recommendation is based on its exposure to future-facing industry trends, unique end-to-end solution suite, and free cash flow profile which can fund investment in operations, product development and targeted growth opportunities.