AGM commentary and trading update

CSS’s AGM highlighted a more sombre trading update that we would have expected, with sales volumes broadly flat YOY and frozen inventories building. Key points:

Sales, harvest and biomass: 1Q24 sales volumes were down -1% YOY and running at an annualised rate below FY23 levels. Harvest volumes were up +23% YOY and biomass at sea was up +10% YOY. Frozen inventories climbed +44% QOQ to 540t. The uplift in Frozen inventories follows a +98% HOH uplift in 2H23 and is a pattern we would ideally like to see reverse over the remainder of FY24e.

Pricing: Average 1Q24 selling prices were up +4% YOY to $22.62/Kg, but down -2% relative to average 2H23 pricing of $23.02/Kg.

Commentary: We note comments that challenging market conditions have persisted throughout 2023, appears more sombre than outlook comments at the FY23 result.

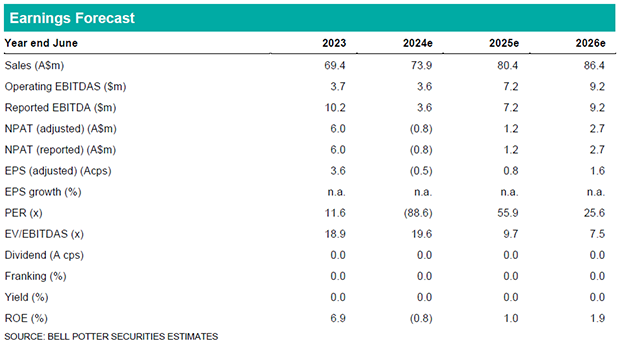

We have reviewed our forecast in light of softer 1Q24 sales volumes trends and easing HOH selling prices from historically high levels. With growing harvest volumes and biomass, we continue to project YOY volume growth albeit at a lower average price point. The net effect is Operating EBITDA downgrades of -35% in FY24e, -24% in FY25e and -21% in FY26e. Our target price is downgraded to $0.48ps (prev. $0.60ps) reflecting a narrowing in gross margin targets and adoption of a higher WACC hurdle (based on a high higher risk free rate).

Investment view: Downgrade to Hold

We downgrade our rating from Buy to Hold. The growth in inventories seen in 1Q24 continues a trend that was observable in 2H23 and needs to be considered in the context of both CSS and TKC expanding biomass at sea. Trading at ~20x FY24e EBITDAS, we see the share price as balancing current operating earnings and the upside from developing the asset base further. While not discounting the turnaround to date, a further re-rating in the CSS share price would likely require a resumption profitable sales volume growth.