September 2023 quarterly report

FMG reported iron ore shipments for the September 2023 quarter of 45.9Mt at C1 cash costs of US$17.93/wmt (BPe 49.0Mt at C1 US$18.02/wmt). C1 cash costs were up marginally on the prior quarter and in-line with our forecast. When adjusted for exchange rate differences, they were in the top half of FMG’s FY24 guidance range. Production was a clear miss, coming in below the bottom of FY24 guidance on an annualised basis and the lowest quarterly shipments for two years. This potentially increases FMG’s risk to the seasonally impacted March quarter. Iron Bridge made its first shipment of magnetite concentrate, but FY24 guidance has been lowered from 7Mt to 5Mt and initial price realisations were at the low end of expectations. FMG’s net debt increased to US$2.2 billion from US$1.0 billion qoq, after the distribution of US$2.0 billion in dividends.

Still hard to see the upside

This was an uncharacteristically slow start by FMG, with production missing, costs at the upper end of guidance and Iron Bridge production downgraded. The market remains in an information vacuum in relation to the Fortescue Energy projects that are set for approval by end CY23 and the investment metrics that will (hopefully) be attached to them. We upgrade our earnings as the iron ore price finds support from looser Chinese Government credit policy, but fundamental demand indicators remain tepid. FMG’s earnings, and more so its dividend outlook, are clouded by the uncertainty of capital allocation in CY24. We continue to see the current share price as a selling opportunity.

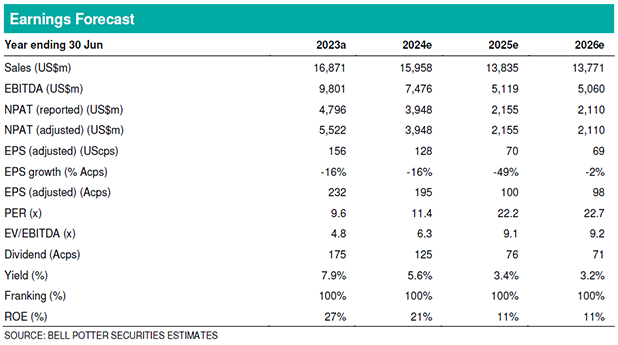

Investment thesis – Sell TP$16.21/sh (Sell TP$15.53/sh)

EPS changes in this report are: FY24: +14%, FY25: -11%; and FY26: -11%, largely on higher forecast operating costs. Our NPV-based valuation is increased by 4% from $15.53/sh to $16.21/sh on favourable adjustments to our iron ore price and AUD:USD forecasts. We retain our Sell recommendation.