Production growth takes a breather

SXY finished FY21 with total production of 17.3PJ (BP est. 17.6PJ), within company guidance of 17-18PJ. Production plateaued in the final quarter to average 52TJ/day and sales were 2% lower on gas processing facility maintenance. Full year revenue was $116m, broadly in line with our estimate of $118m. Over the quarter, SXY’s net cash position fell to $26m (from $36m); at quarter end, the company had cash of $101m and $50m in undrawn debt.

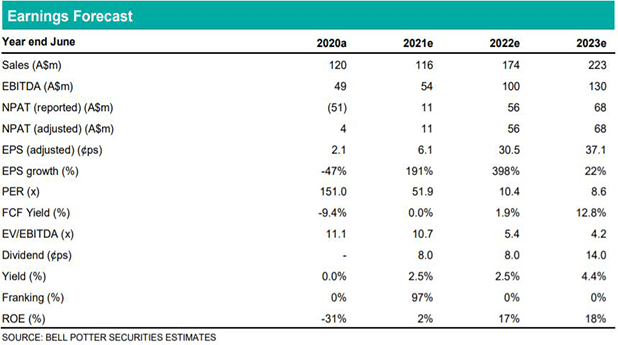

EPS changes in this report are: FY21 now 6.1cps (previously 8.8cps); FY22 -2%; and FY23 no change.

Next phase of expansion on track

Roma North’s expansion to 9PJ/year (25TJ/day) is expected to be online in the current quarter. Together with Atlas currently at around 12PJ/year (33TJ/day), the Roma North expansion will increase group nameplate capacity to around 21PJ/year (58TJ/day). Taking Atlas to 18PJ/year and therefore group capacity to 27PJ/year (74TJ/day) is through front end engineering design (FEED) with FID dependent on customers signing term contracts. Roma North’s next expansion to 18PJ is also through FEED and could further increase group capacity to 36PJ/year (99TJ/day), FID is expected by the end of 2021. SXY reiterated its longer term target of lifting group production to more than 60PJe/year by the end of FY25.

Investment thesis: Buy, Target Price $3.75/sh

SXY provides leverage to Australia’s east coast gas market where supply deficits are supporting high prices. Near term earnings growth is from ongoing production growth, improved domestic prices, and improved GLNG offtake prices as lagged oil-linked gas prices flow through. The company has brownfield expansion projects and a track record in project development. SXY is funded to pursue its growth aspirations, with net cash and supportive bank debt. We also expect dividends to form an increasing component of shareholder returns.