Strong 4Q21 sales update, FY21 headline result ahead BPe

JBH has provided a sales update for 4Q21, and released preliminary unaudited FY21

headline results. The key highlights are as follows:

4Q21 sales update:

- JB Hi-Fi Australia like-for-like (LFL) sales of -7.8% (cycling +31.4%);

- The Good Guys LFL sales of -1.5% (cycling +30.2%);

- JB Hi-Fi NZD (a small contributor to JBH) LFL sales of +46.9% (cycling -24.1%).

Preliminary unaudited FY21 headline results:

- FY21 sales of $8.9b, +4.6% ahead vs BPe $8.5b and up +12.6% vs pcp;

- Within this online sales lifted +78.1% to $1.1b, representing 11.9% of total sales;

- FY21 EBIT of $743.2m, +15.6% ahead vs BPe $642.9m and up +53.8% vs pcp;

- Strong improvement in gross margins, combined with disciplined cost control and strong sales growth, drove significant operating leverage.

July comments: “…expecting some disruption and variability to sales as a result of the

various state based COVID restrictions”. A July update will be provided on 16 August.

Earnings changes / Investment view: Retain Hold, PT $46.50

The 4Q21 update reveals continued heightened demand for consumer electronics and home appliance/entertainment products. Lockdowns will obviously cause disruption in Jul/Aug, although we note Dec-Quarter trading is the key swing factor for JBH’s 1H22. From a bottom-up perspective, the update further demonstrates: 1) JB Hi-Fi remains a key destination retailer for technology/consumer electronics; & 2) a materially stronger Good Guys business that resonates strongly with consumers for home appliances.

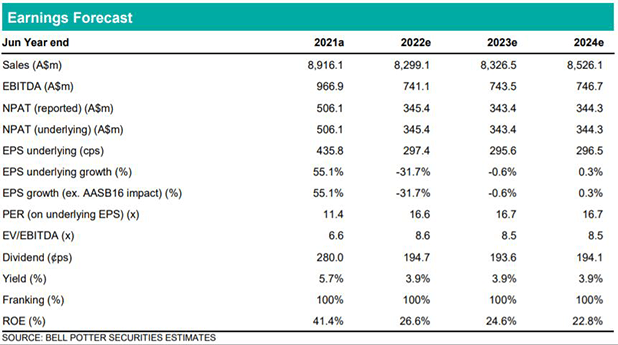

We have updated our FY21 with pre-audit actuals and rolled forward our model. Net effect is our FY21 (now shown as ‘actual’)/FY22e EPS increase by 15%/3.7%. Our PT increases to $46.50 (previously $45.50). Based on valuation on a normalised base and increased near-term uncertainties (as a result of COVID), we retain our Hold rating.