Strong 1H21 result as flagged, 2H21 also off to a strong start

PMV announced a strong 1H21 result ahead vs its 13 January update, with EBIT (pre-AASB16) lifting 88.5% vs pcp to $237.8m (vs guidance $221m-$233m). The uplift was mostly driven by margin gains (gross margin +286bps, CODB/sales -870bps) reflecting online acceleration (higher margin channel), Peter Alexander outperformance (higher

margin brand), reduced promotions and opex leverage on tight cost controls. Sales performance was also robust, increasing 7.2% despite store closures, with global likefor-like sales (ex. store closures) up 18.2% (within this online sales lifted 61% vs pcp). Partially offsetting these positives, Smiggle sales fell 26.5% due to COVID disruptions.

With headline numbers pre-released, we highlight the following key new information:

- Strong momentum has continued into 2H21: Global LFL sales (i.e. ex. store closures) up 32.1% & gross margin up 379bps for first 7 weeks of 2H21. Growth continues to be underpinned by Peter Alexander, online and the Apparel brands.

- Rent rebased down 318bps: PMV has reached agreement with key landlords that has rebased rent at 12.7% of 1H21 sales, down 318bps vs pcp. This result is ahead vs BPe and will further enhance PMV’s opex leverage moving forward.

- Offshore opportunity for Peter Alexander: Given consistent outperformance, PMV was upbeat on the offshore growth potential for Peter Alexander (designer- led brand in demand), although we see this more of a late-FY22 / FY23 decision.

- Strong balance sheet: At end-1H21 PMV had net cash of $350.5m which includes $497.2m in free cash held by PMV outside the Just Group. In addition, PMV’s investment stake in BRG has a current market value in the region of ~$1b.

Earnings changes / Investment View: Retain Hold, PT $25.00

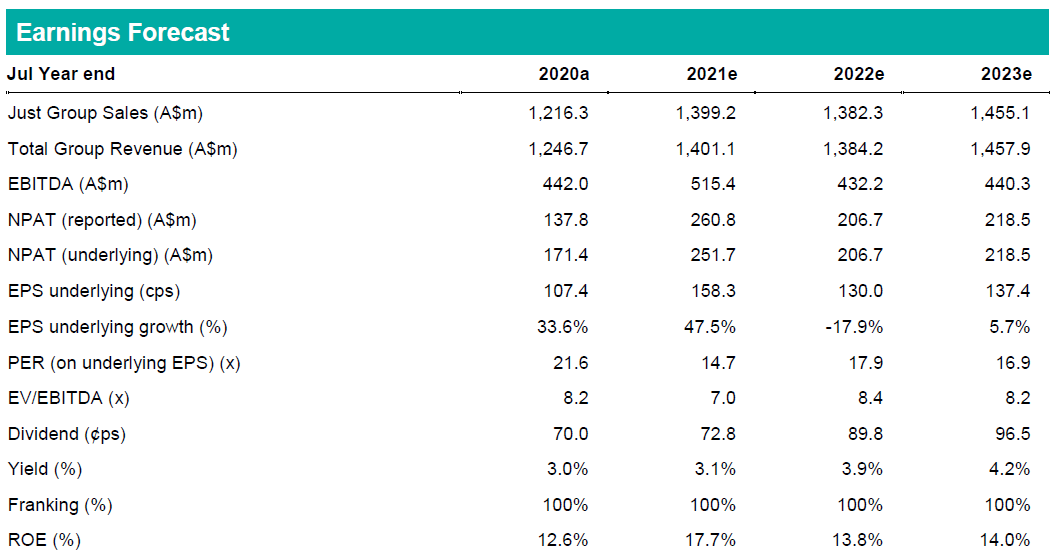

We have strengthened sales and reduced our rent expense assumptions. Net effect is our FY21/FY22/FY23 EPS increase by 4.8%/10.8%/8.8%. Our PT increases to $25.00 (previously $23.90). We recently downgraded our rating to Hold following the 13 Jan update. While today’s update reveals several positive developments (as noted above), we are reluctant to upgrade given the continued reduced visibility on Smiggle’s growth profile, an anticipated normalisation in earnings, & based on valuation. Hold retained.