Monthly flows, and mark to market changes to forecasts

The company saw funds under management (FUM) lower at $21,118m, driven by outflows of $205m or 0.9% and a reduction due to market levels of $1,140 or 5.1%.

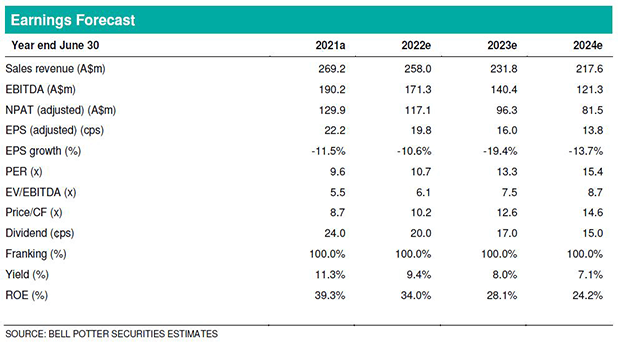

While the outflows were only slightly below our forecasts of 0.7% per month, the market move is material and therefore we have taken the opportunity to mark our forecasts to market. This reduces our expected FUM by 6.2% in 2022. Our revenue forecast reduces by 2.1% for 2022, 6.2% for 2023 and 6.4% for 2024. EBITDA reduces by 3.1% in 2022, 9.8% for 2023 and 11.1% for 2024.

Investment view: Hold, Valuation $1.90 per share

Our target price is reduced to $1.90 per share (previously $2.08), set using a DCF valuation. This is 8.6% below our previous forecast due entirely to the 9.8% lower EBITDA forecast.

Our recommendation moves to HOLD, in accordance with our ratings structure. The next news event is the Annual Investor and Advisor presentation due later this month.

Should there be a resolution or peace agreement in Ukraine, we would hope to see markets stabilise and recover back towards previous levels, which could trigger a corresponding rebound to our forecasts and valuation. With markets remaining fluid, we would look for more certainty before revisiting the shares. With this update our earnings forecasts reduce by 3.1% for FY22, 9.9% for FY23 and 11.1 for FY24.