Transfer of coverage. Positive view maintained.

We have had a change in analyst for Flight Centre Travel Group (FLT) which was last published in Aug’21, resulting in a change to our forecasts and valuation. However, we retain our positive view on FLT’s outlook and competitive position as global travel recovers in CY22e, supported by strong organic growth in the Corporate business and a restructured Leisure business that is highly leverage to the return of International outbound Australian travel. While there is still some uncertainty to recovery pathway, we believe sustained reopening’s on milder COVID variants and increased global vaccinations is the base case, with consensus estimates on forward TTV and PBT/TTV margins not onerous in our view. Key highlights of our thesis are:

Market overlooking structural growth in Corporate: Consensus and BPe are assuming limited future structural Corporate TTV growth, despite A$4.5bn (annualised pre-COVID expenditure) in new business wins since the pandemic began and TTV growth of ~16% 9-year CAGR to FY19. Customer expenditure only needs to return to ~60-75% of pre-COVID levels, to achieve FY19 TTV, which is expected in FY23e.

Leisure would likely surpass FY19 PBT on lower TTV levels: FLT expects a full TTV recovery in Leisure by FY24e. However, it’s likely that Leisure would not need to return to pre-COVID TTV levels to surpass the FY19 PBT given significant reductions to the legacy cost base and soft FY19 Leisure profitability (PBT margins were 0.9%).

Liquidity suggests FLT well capitalised: Pro forma Dec’21 liquidity implies ~42 months cash runway at the current cash burn. With Corporate approaching breakeven (targeting a return to profitability in 3Q22e) and Leisure expected to be breakeven by the end of FY22e, we expect outflows to dissipate, while a working capital recovery and ~$1.2bn grossed up of tax losses should support balance sheet repair.

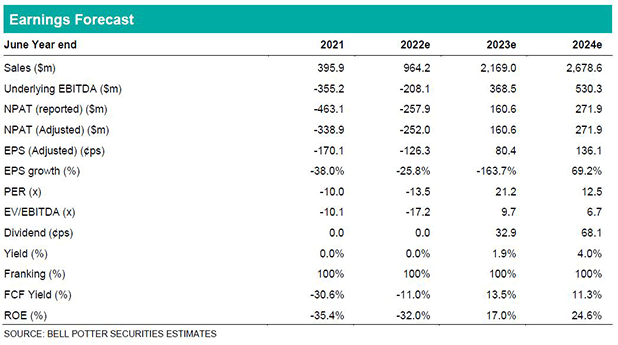

Earnings changes and recommendation: We update our forecasts for Underlying EPS for the 1H22 result (which was heavily impacted by Omicron) and adjustments to forward TTV assumptions resulting in changes of -395%, +27% and +24% in FY22e, FY23e and FY24e respectively. We maintain our Buy recommendation on FLT, with a revised Price Target of $20.50ps (Prev. $20.00ps).