Nickel market mayhem

NIC entered and subsequently exited a Trading Halt on Wednesday 9 March, following a 23% drop in its share price in morning trade on the ASX. This resulted from speculation around the possible implications for Tsingshan Holding Group (a private company), the world’s largest stainless steel producer and parent company of Shanghai Decent Investment (SDI). SDI is NIC’s largest shareholder (17.9%) and partner in the Indonesian Morowali Industrial Park (IMIP) and Indonesia Weda Bay Industrial Park (IWIP), where NIC’s Nickel Pig Iron (NPI) operations are hosted. According to reports, Tsingshan held a 200kt nickel short position, struck at US$21,000/t. Following the suspension and cancellation of LME nickel trades for Tuesday 8th March, the mark-to-market valuation of the position, calculated on Monday’s cash closing price of US$48,200/t, was ~US$7.4 billion. Market concerns related to the solvency of Tsingshan, the status of operations and development at the IWIP and IWIP and the potential forced sale of SDI’s shareholding in NIC.NIC entered and subsequently exited a Trading Halt on Wednesday 9 March, following a 23% drop in its share price in morning trade on the ASX. This resulted from speculation around the possible implications for Tsingshan Holding Group (a private company), the world’s largest stainless steel producer and parent company of Shanghai Decent Investment (SDI). SDI is NIC’s largest shareholder (17.9%) and partner in the Indonesian Morowali Industrial Park (IMIP) and Indonesia Weda Bay Industrial Park (IWIP), where NIC’s Nickel Pig Iron (NPI) operations are hosted. According to reports, Tsingshan held a 200kt nickel short position, struck at US$21,000/t. Following the suspension and cancellation of LME nickel trades for Tuesday 8th March, the mark-to-market valuation of the position, calculated on Monday’s cash closing price of US$48,200/t, was ~US$7.4 billion. Market concerns related to the solvency of Tsingshan, the status of operations and development at the IWIP and IWIP and the potential forced sale of SDI’s shareholding in NIC.

Business as usual for NIC

NIC has stated that production, commissioning and construction activities at the IMIP and IWIP are unaffected by these developments. Tsingshan has provided assurances it will not be selling any shares in NIC, it will continue to purchase all NPI produced by NIC at market prices and, as outlined in the terms for NIC’s acquisition of 70% of the Oracle Nickel Project, it will accept NIC shares as part consideration. In the meantime, we believe it is likely Tsingshan (annual revenues US$56 billion and regarded as the world’s lowest cost stainless steel producer) will close out its short position, supported by physical delivery, without compromising its long-term financial viability.

Investment thesis – Buy, TP$1.76/sh (unchanged)

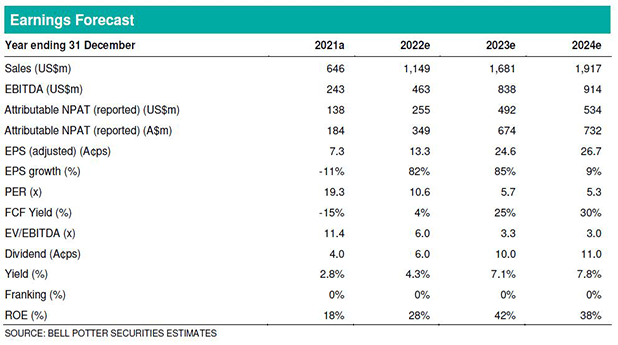

We make no changes to our forecasts or valuation with this update. The underlying fundamentals of the business are unchanged, other than that we expect upward pressure to be applied to Nickel Pig Iron (NPI) prices. We view NIC’s steep price drop as an acquisition opportunity. We continue to forecast aggressive EPS growth of 82% and 85% for FY22 and FY23 and we retain our Buy recommendation.