Memorandum of Understanding locks in growth

NIC announced it has signed an MoU outlining: 1) the acquisition of a 70% interest in 4 next-generation Rotary Kiln Electric Furnace (RKEF) lines currently under construction within the Indonesia Morowali Industrial Park (IMIP), for consideration of US$525m (100% valuation US$750m). The new lines comprise the Oracle Nickel Project (ONI) and are expected to commence commissioning in Q1CY23; 2) Establishment of a “Future Energy” collaboration framework to optimise the transition to renewable energy sources; and 3) the planned participation in future High Pressure Acid Leach (HPAL) nickel projects, utilising NIC’s current and prospective mineral resources across Indonesia, to produce battery grade nickel.

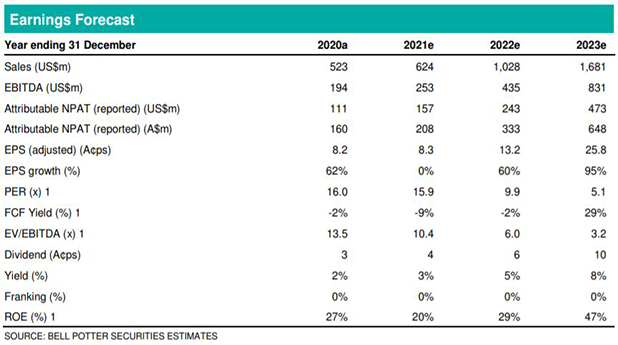

Sector leading earnings growth outlook

This is a multi-faceted agreement that deepens and expands NIC’s partnership with Shanghai Decent Investment (SDI). The primary update is the ONI acquisition. The project replicates the specifications of the next generation RKEF lines of the Angel Nickel Project, with annual nameplate production of 36ktpa Ni in NPI, currently in the advanced stages of construction and in which NIC has an 80% interest. Incorporating the ONI acquisition into our forecasts builds further, aggressive production and earnings growth into NIC’s outlook. We now forecast a tripling of US$ earnings from CY21 to CY23 on production growth of 2.4x. There is potential upside to our for

Investment thesis – Buy, TP$1.68/sh (from $1.42/sh)

This MoU follows on news of the ahead-of-schedule progress at the Angel Nickel Project which lifted our forecast CY22 EPS growth from 29% to 60% (Acps basis). The Oracle acquisition now lifts our forecast CY23 EPS growth from 68% to 95%, resulting in an extraordinary growth profile for an industrial style company. NIC is now trading on EV/EBITDA multiples of 6.0x and 3.2x and P/E multiples of 9.9x and 5.1x for CY22 and CY23 respectively. This reinforces NIC as one of our top picks in the sector and we retain our Buy recommendation.