ACCC not opposed to NAB’s buy of Citi consumer business

The ACCC will not oppose NAB’s buy of the Citi consumer business as the transaction should not lessen competition. This is even after the fact NAB and Citi overlap in retail banking products and services including home loans, transactions/savings, wealth management, personal and credit cards.

Primarily, the transaction’s main focus is on credit cards as the other products and services are minimal when it comes to market share. As for credit cards, the ACCC review process included the potential gains in market share, talking to various stakeholders (other suppliers, third party distributors, etc.) and other consumer groups. It found that there was again minimal noise from the account and NAB would still face competition from an enlarged customer base (and this is despite the increasing growth in BNPL schemes). In other words, Citi would still not be unique in its credit card offering and NAB’s purchase will still not materially change its own position (i.e. NAB remains smaller than the other majors even after the acquisition).

The other thing is that NAB might offer less favourable terms post acquisition to the smaller players. ACCC found NAB would be unlikely to act in that manner given the importance of scale and including relative setup costs (more so for NAB in, for example, trying to invest in its own platform). The proposed acquisition now rests with regulatory approvals from the Commonwealth Treasury and APRA, and completion is still scheduled for first half of calendar year 2022.

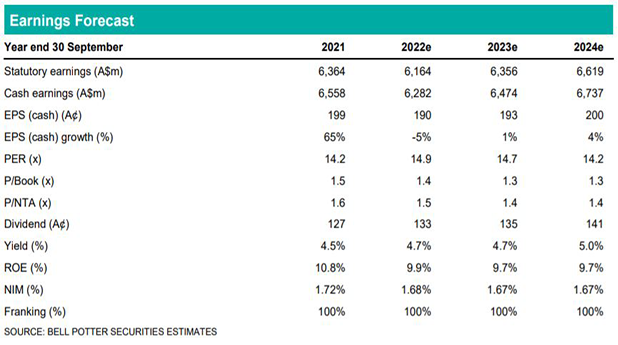

Price target $32.00, maintain Buy rating

Our earnings expectations are unchanged for the time being, likewise the valuation and price target of $32.00. With a 12-month TSR of greater than 15%, we still maintain NAB’s Buy rating.