Opinion Piece – The LIC sector trades at a discount to NTA… Right?

Listed Investment Companies (LICs) are required to disclose their pre-tax and post-tax NTA (net tangible assets) per share every month, 14 days from the month’s end. In this piece we discuss one method for identifying and determining the importance of pre-tax NTA versus post-tax NTA, as well as the treatment of pre-tax and post-tax net effects considered in this calculation. By using Portfolio Turnover ratios as a determinant for the timing of tax liabilities, we find that the sector ebbs and flows around par value on a market cap weighted average basis, providing frequent opportunities for investors to benefit from the oscillation in premiums and discounts.

Top Picks

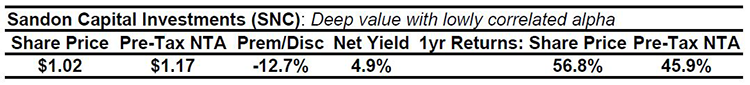

Investment Manager Sandon Capital is an Australian-based activist investment firm that regularly engages with misunderstood companies in seeking to promote positive changes, aiming to transform these businesses so that their intrinsic value is better appreciated by the market. Influencing the direction of a company is a long-term focus. Returns from activist investment approaches often follow the shape of a j-curve, with an initial loss immediately followed by dramatic gains, similar to private equity. The result is a long duration, highly concentrated portfolio with a much greater likelihood for company-specific factors to drive the return outcomes.

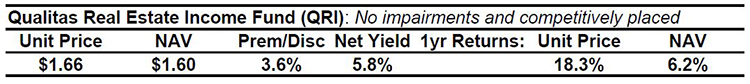

QRI aims to provide investors with monthly cash income and capital preservation through a portfolio of Australian originated Commercial Real Estate (CRE) loans, secured by real property mortgages that are diversified by borrower, loan type, property sector and location by specialist Manager Qualitas. The Trust seeks to achieve a Target Return equal to the prevailing RBA Cash Rate plus a margin of 5.0-6.5% p.a. net of fees and expenses, where it has consistently performed at the upper end of this scale, with a trailing 12 month distribution return of 6.2% based on the $1.60 IPO price for 30 September. There have been no impairments or interest arrears across the loan portfolio, resulting in a stable NAV position since the float. Growth in borrower demand for alternate financiers and a pull-back from the banks in the c. $355bn Australian CRE debt market as a result of increased regulatory and capital requirements also bodes well for Qualitas.

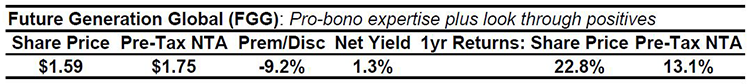

FGG was Australia’s first internationally focused LIC with the dual objective of providing shareholders with diversified exposure to a select pool of prominent global fund managers, in lieu of management fees, while supporting children and youth mental health charities. An increase in socially responsible investing makes this seem attractive at a discount. FGG also currently distributes income on an annual basis, while it’s domestic-focused sibling has a semi-annual payout frequency. During the half-year ended 30 June 2021, the Board reassessed the accounting classification for investments. As a result of this change, the company’s distributable profit reserve to shareholders has increased, providing additional flexibility on dividend and capital management decisions.