Exceedingly strong FY21 result

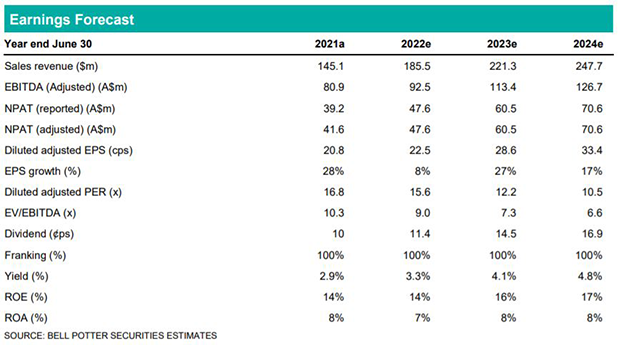

MNY has reported an exceptionally strong FY21 result, delivering reported NPAT of $39.2m (+30.2% on a normalised basis), modestly exceeding our estimates and full year NPAT guidance of $38.0m. Excluding one-off items relating to AFS acquisition, tech investment, Job keeper adjustments and amortised borrowing costs associated with MNY’s Fortress loan, the company reported normalised NPAT of $41.6m and Underlying EBITDA of $82.4m (+35.8% YoY). The strong result was driven by loan book growth of 38.5% YoY to $600.9m (Inc. contribution from AFS), along with firm credit quality control, which saw impairment and provision related expenses decline -49.7% YoY. MNY exited FY21 with loan book leverage of ~50% ($262.3m of drawn debt), and the company maintained a cash balance of $55.2m. A final dividend of 7.0cps (fully franked) was declared.

Conditions remain positive for FY22 outlook

Whilst MNY has not provided formal FY22 earnings guidance, the company expects to deliver >20% growth YoY ‘in-line with consensus’. MNY has flagged cash collections to normalise to historical levels in FY22 which should support loan book growth of between ~26.5%-37.8% to ~$760m-$810m. The company continues to be well placed to see ongoing provision and impairment cost control as loan book quality improves and COVID-19 economic provisions unwind. Improved leverage of MNY’s loan book (toward 60%) across its four debt facilities in FY22 should see further rates decline. Overall, this should support MNY’s trajectory toward its ROE target of ~15%, and BPe forecast NPAT of ~$47.6m in FY22.

Investment View: Buy retained, revised PT of $4.15ps

Following MNY’s result, we upgrade our loan book assumptions by ~6% in FY22-FY23 to align more closely with MNY’s expectations. Modest adjustments to forecast revenue margin estimates were offset by reductions in our BDD assumptions. Overall we upgraded our EPS estimates by +0.2%, +5.6% in FY22-23e respectively. We increase our price target to $4.15ps (previously $3.70ps), and retain our Buy recommendation.