Strong FY21 result…

AX1 announced a strong FY21 result, with FY21 EBIT lifting 31.8% to $124.9m, 2.7% ahead BPe $121.6m. The strong result was driven by: 1) 8.3% like-for-like (LFL) sales growth; 2) online sales lifting 48.5%; 3) 30bps gross margin expansion; 4) operating leverage benefits; and 5) strong store rollout progress with 83 net openings. Note, the FY21 result includes the net benefit of wage subsidies in 1Q21 of $9.4m.

…although lockdowns materially impacting 1H22

COVID restrictions/lockdowns in July/August have had a material impact, as follows:

- Trading update for first 7 weeks: LFL sales (incl. store closures) down -16% (cycling +1.3%). Online providing some cushion to lost in-store sales, although at a reduced extent vs last year (noting Jobkeeper stimulus buoyed sales last year). Group EBIT impact of at least -$15m: Noting this is for July and August alone.

- Inventory position on the ‘heavy side’, but a fortunate position given supply chain risks: AX1 exited FY21 with $217m in inventory, which we est. to be $30m on the ‘heavy side’, although AX1 noted the inventory is new/on-season product. Lockdowns will slow the rebalance of stock levels, which is seeing promotions increase; although at the same time we believe having excess inventory is a preferred position ahead of the key Dec quarter given global supply chain risks.

- Solid balance sheet to navigate difficult backdrop, with modest leverage ratio of 0.4x at end-FY21. Landlord negotiations, round 2: AX1 flagged it is in the process of engaging with landlords (like last year) to determine appropriate rent terms during lockdowns, thereby containing 1H22 rent cash outlay to a fair level.

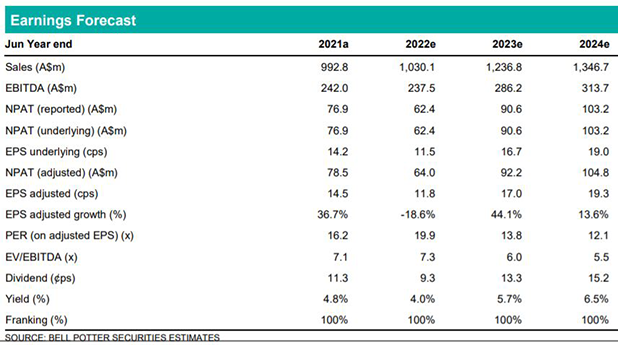

Earnings changes & Investment View: Retain Buy, PT $2.90

We have cut our 1H22 estimates to reflect lockdown impacts. The net effect is our FY22 EPS falls by -21%, although there is no material change in FY23/FY24. Including model roll-forward, our 12-month price target reduces to $2.90 (previously $3.30). Notwithstanding the material near-term lockdown impacts, the underlying fundamentals of the business remain strong and attractive. We retain our Buy rating on the stock.