Positive market update

Life360 provided a positive and unexpected market update with two key metrics in 1Q2024 materially exceeding both our and market expectations: 1. Global monthly active users increased 4.9m to 66.4m (vs BPe 2.6m increase to 64.0m); and 2. Global paying circles increased 96k to 1.897m (vs BPe 66k increase to 1.867m). No explanation or commentary was provided as to what drove the strong growth and the company said it was too early to determine whether these metrics will have a material positive impact on revenue, earnings or any other financial results for 1Q2024. Both metrics are clearly very strong but in our view the growth in paying circles is key as this metric disappointed somewhat in 4Q2023 with an increase of only 55k – albeit after very strong growth in 3Q2023 – so growth of 96k in 1Q2024 signals a strong rebound.

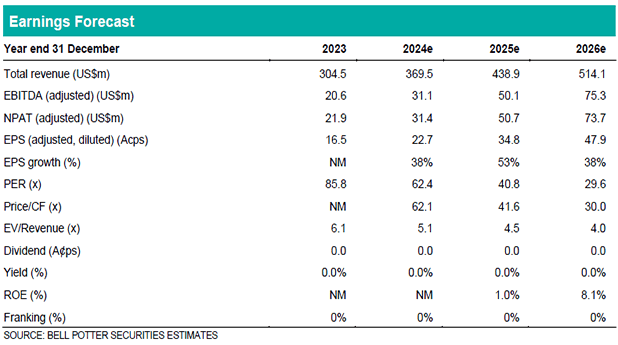

Modest upgrades

We have upgraded our revenue forecasts in 2024, 2025 and 2026 by 1%, 3% and 4% on the back of increases in our subscription revenue forecasts – driven by increases in our paying circles forecasts – and also our advertising forecasts. We now forecast 2024 revenue of US$369.5m which is near the middle of the US$365-375m guidance range. We have also upgraded our adjusted EBITDA forecasts by 2%, 2%, and 3% on the back of the revenue upgrades and now forecast 2024 adjusted EBITDA of US$31.1m which is still towards the lower end of the US$30-35m guidance range.

Investment view: PT up 12% to $16.25, Maintain BUY

We have updated each valuation used in the determination of our price target for the forecast changes and also increased the multiple we apply in the EV/Revenue valuation from 4.75x to 5.5x due to the positive update and also successful IPO of Reddit on the NYSE. The net result is a 12% increase in our PT to $16.25 which is a 15% premium to the share price and we maintain our BUY recommendation. The next potential catalyst for the stock is the 1Q2024 result on 10th May which we expect to be good with strong double digit growth in revenue and continued improvement in EBITDA. At this stage, however, we would not expect an upgrade in the guidance.