Higher costs coming in McPhillamys DFS

We have reviewed our valuation of RRL’s 100%-owned McPhillamys Gold Project (MGP) following the recent update of estimated costs of key elements of the project. This has been provided ahead of the release of the Definitive Feasibility Study (DFS) on the project, expected around end FY24. The last detailed announcement on the MGP was the Preliminary Feasibility Study (PFS) of September 2017 (long out of date), against which we had made our own key cost assumptions. RRL has guided that input cost inflation and scope changes since the PFS have resulted in material capital and operating cost increases, including updated total construction costs of A$845-$900m and life-of-mine (lom) average All-In-Sustaining-Costs (AISC) of A$1,600-$1,800/oz. RRL continues to await final Commonwealth approvals. Modifications arising from this process are likely push a Final Investment Decision (FID) to late FY25, with a potential 2-year construction phase commencing in FY26.

Higher gold price keeps it attractive

RRL’s update guides to material cost increases compared with our prior assumptions, which included pre-production CAPEX of A$550m and AISC of A$1,440/oz. Other project parameters are largely unchanged, other than gold processing recoveries lifting from 85% to 88% on a revised process route. All else being equal, these increases would have had a significant impact on project returns and valuation. However, in the context of the spot gold price (A$3,550/oz) and our latest long-term gold price forecast (~A$3,200/oz) the MGP remains an attractive project. In reflecting the longer-dated development timeline (we had been expecting FID around end FY24) and the higher quantum of funding, we increase our risk-adjustment discount for the MGP. The net result is that our valuation is effectively unchanged.

Investment thesis – Buy, TP $2.60/sh (unchanged)

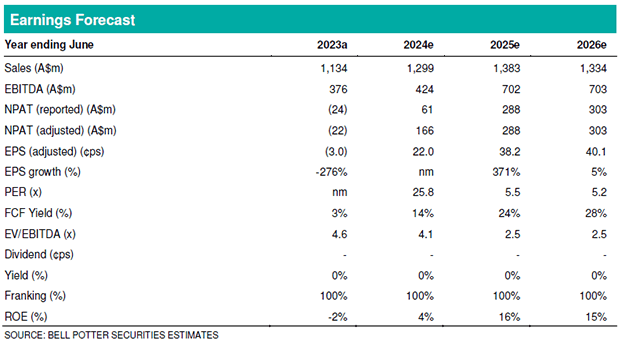

There are no earnings changes in this report. With this update we see an opportunity emerging for RRL to build cash ahead of a potential FID as well as optionality on funding of the MGP. We view the clarification on costs as a positive de-risking event.