ABARE forecasts highlight the leverage

The recent ABARE commodities report highlights the leverage play in BGA’s ingredients business. We see this upside potential as underappreciated by the market.

BGA is most leveraged to SMP prices: Despite the recent pullback in SMP pricing in the last GDT pulse auction, futures prices continue to indicate a higher average selling price in FY25e vs. FY24 by ~A$100/t. This compares to ABARE’s latest forecast ~US$400/t YOY gain in SMP into FY25e. These values would imply a potential $4-20m YOY EBITDA tailwind in FY25e all other things being equal.

Farmgate pricing could be a game changer: The latest ABARE forecast is for a 4.4¢/L YOY fall in FY25e farmgate milk prices. If realised, a fall of this magnitude would represent a $55-60m reduction in milk COGS for BGA. Importantly we factor no material downdraft in farmgate pricing assumptions in our FY25e forecasts.

Self help is underappreciated: BGA highlighted at it’s 1H24 results that it remains on track to deliver >$20m in annualised cost savings, with a likely phasing to 2H24e.

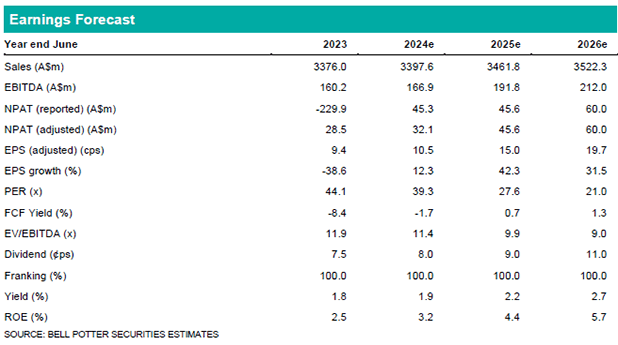

Trading multiple light relative to historical average: While BGA has re-rated materially from its Sep’23 low, it is still trading at a material discount to its historical 1yr FWD EV/EBITDA multiple of 12.3x, trading at 11.4x FY24e and 9.9x FY25e. These also represent a material discount to global dairy (12.7x) and FMCG (12.4x) peers.

In our view, the pathway to BGA achieving its >$250m EBITDA target is becoming clearer, with the realignment of domestic processor capacity to farmgate supply creating a greater degree of contingency in the ingredients business.

Investment view: Buy rating unchanged

Our Buy rating is unchanged. The recent ABARE commodities report highlights the operating leverage BGA has to SMP and farmgate pricing. A realignment in farmgates to commodity markets in our view provides the largest upside risk to near term forecasts and BGA’s 5yr >$250m EBITDA target. Should the market accept BGA’s EBITDA target as achievable, while re-rating it towards its long-run EV/EBITDA multiple, then the upside is compelling.