Revisiting Cettire’s fulfilment and returns policy

We have revisited Cettire (CTT)’s fulfilment and returns policy including the latest customer reviews in comparison to luxury e-commerce peers since our last assessment in Nov-22. We view overall fulfilment currently in place at CTT as in line with broader complexities associated with cross-border e-commerce as evident to us from discussions with industry specialists. In terms of CTT’s customer reviews with the majority associated with the returns policy, we note that overall ratings have remained relatively unchanged on a much larger base in total reviews in line with the growing size of the business but broadly within the range of its peers. While CTT remains a younger company as compared to luxury e-comm peers, the company continues to prioritise investing into technology solutions & customer service to improve the returns experience related to first time customers.

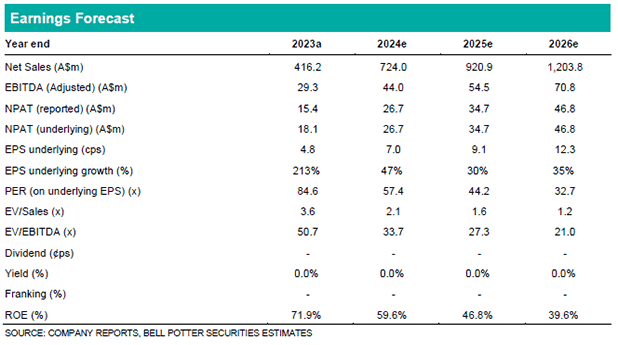

Earnings changes and 3Q24 preview

We make no changes to our forecasts as our revenue drivers and margin assumptions remain unchanged. CTT last updated the market in Feb-24 at the 1H24 result reporting that sales revenue was +80% on pcp for the month of January. Our 3Q/2H24 forecasts factor in the strong comparable period and see sales revenue growth of ~66% on pcp driven by both core and emerging markets. Our EBITDA margin assumptions reflect the usual seasonality of margins in 2H. We look for updates on the company’s China launch with market entry imminent.

Investment View: PT unchanged at A$4.80, Maintain BUY

Our estimates and PT remain unchanged. Our A$4.80 PT is based on an equally weighted DCF (WACC 12.6% TGR 3.5%) and relative valuation (utilising a target EV/EBITDA multiple of 15x on a FY25e basis). We think CTT’s ability to outperform their peer group far outweighs others given the ~0.9% market share and further supported by the ongoing consolidation in the luxury e-commerce market. We also view CTT’s current EBITDA margins ahead of other e-commerce players with minimum risk associated with the drop-ship inventory model. We retain our BUY rating.