Opinion Piece – Unlocking value through options and convertible securities

In an effort to equitably and efficiently scale the magnitude of Company assets, many LICs are beginning to offer bonus options after listing. In this opinion piece, we discuss the decision making process ahead of option holders, underscore those that are due to expire this calendar year; and deconstruct the inherent value of these options, both those issued directly to equity holders at no additional cost, and through embedded conversion decisions offered on hybrid securities by LICs issuers.

Top Picks

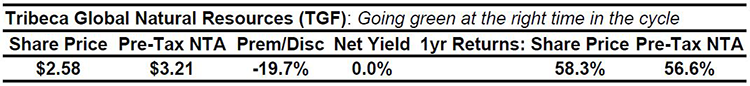

TGF implements an active long/short investment strategy that seeks to benefit from the inherent volatility associated with the global natural resources sector. The Fund initiated a long position of ~7.5% in a diversified mix of ~14 nature based and renewable energy carbon credits back in August 2021. A carbon credit is a tradeable unit representing the reduction or removal of one tonne of carbon dioxide equivalent from the atmosphere that is retired upon use. The Singapore Carbon Exchange and UN Climate Change Conference have already been major catalysts for this new asset class, with higher carbon taxes and an ongoing supply shortage in offset credits highly likely to provide additional near-term upside.

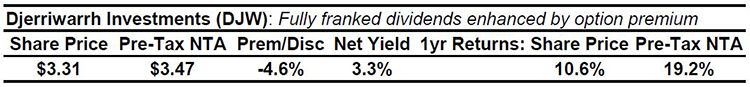

DJW invests in Australian equities with a focus on stocks where there is an active options market and/or sustainable dividend yield. The company aims to provide shareholders with attractive investment returns through an enhanced level of dividends and attractive total returns over the medium to long-term. Prospects of multiple rate rises and resurgent volatility is highly accretive to the Company and its unique portfolio covered call-write strategy, which should lead to a more viable extraction of option premium (the price paid consisting of intrinsic value and extrinsic value), and where option coverage can be accordingly dialed up or down based on market conditions.

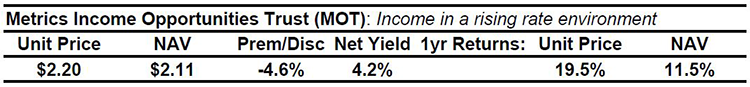

MOT provides exposure to a diversified portfolio of Australian private credit and other equity-like securities such as warrants, options, preference shares and equity. The Trust’s target cash income distribution is 7.0% p.a, with a total target return of 8.0-10.0% p.a. through the economic cycle. With most loans based on a floating market rate, this exposure should cushion or preserve capital in an environment of rising interest rates and inflation. Meanwhile increasing global vaccination rates and reopening economies may telegraph less risk in financial markets and thinner credit spreads over similar dated government guaranteed bonds. The ability to add an illiquidity premium with higher pricing to the return on private credit investments will be favourable against this backdrop. The broader investment mandate also enables the Manager to rotate in and out across the full spectrum of private credit investments (plus warrants, options, preference shares and equity) based on attraction.