1H22: $4.75bn cash NPAT, 175¢ interim dividend

CBA’s result includes: 1) cash NPAT (continuing operations) $4.75bn (BP $4.38bn); 2) cash EPS (continuing operations) 273¢ (BP 247¢); 3) interim dividend 175¢ (BP 162¢) fully franked (payout ratio 62%); 4) ROE (continuing operations) 12.3% (BP 11.4%); 5) NIM (continuing operations) 1.92% (BP 1.93%); 6) loan impairment expense – $0.07bn/-2bp GLA (BP $0.32bn/8bp); and 7) CET1 ratio 11.8% (BP 11.4%).

We will focus purely on cash NPAT from continuing operations. CBA’s $4.75bn cash NPAT was 8% higher than our forecast and was mainly due to a benefit in loan impairment. Regardless, this was another strong outcome despite low interest rates and purely as a result of COVID-19. Other than a loan impairment benefit of $0.07bn/2bp GLA, this was also due to continued volume growth in home lending, business lending and deposits (above system growth in all core markets), disciplined and flat operating costs, reduction in remediation costs and, above all, a still improving economic outlook. Cash NPAT was nearly on par with 2H21, a great outcome. There was also investment in operational execution (in line with the bank’s strategic priorities) coupled with a return of excess capital to shareholders of $2bn (on-market share buyback; surplus capital post buy-back would be around $4bn). Finally, the interim dividend was set at 175¢ being fully franked (no DRP, neutralised).

$108.00 price target unchanged, back to a Buy

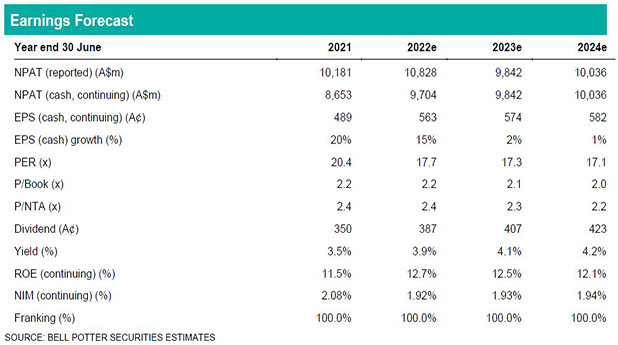

While cash earnings in FY22e and FY23e are increased substantially by 11% and 8%, these were mainly due to lower credit impairment expenses [FY22e $101m (previously $728m) and FY23e $761m (previously $1,113m)]. There were also benefits from higher total operating income every year (4-5%) mainly from volume-related lending and deposit fees. Given that, cash earnings were increased by 2% from FY25e onwards. Net of higher risk metrics (sustainable dividend yield up by 25bp to 3.75% and discount rate up by the same amount to 9.75%), the amount is only break-even – meaning the valuation and price target are unchanged from $108.00. Allowing for the current interim dividend of 175¢, the rating for CBA is brought back to a Buy.