Solid result, Home Improvement adds new growth horizon

TPW announced 1H22 revenue of $235.4m (vs BPe $231.4m), up +46% YoY. 1H22 EBITDA of $12.0m was in line vs our $11.9m estimate. Key highlights of the result are:

- Revenue growth holding up well vs difficult backdrop: 1H22 revenue growth of +46% (cycling +118%) compares with +56% growth to 15 Oct’21, implying only a modest slowing exiting the half despite the end of lockdowns. Entering 2H22, revenue growth remains solid with 2H-to-date revenue up +26% YoY (cycling >100%) despite softness in the broader consumer market due to omicron.

- 1H22 EBITDA margin of 5.1%, although full year EBITDA margin guide of 2-4% reaffirmed: TPW previously provided EBITDA margin guide of 2-4% during its ‘scale up’ phase. The company reaffirmed this range for FY22, although 1H22 was above at 5.1% due to the timing of investments (as guided at TPW’s AGM).

- New growth horizons gaining traction and materially expand TAM: Trade & Commercial (~7% of revenue) increased +49% YoY despite lockdown disruptions while TPW’s new Home Improvement offering (~4% of revenue) lifted +95%. The Home Improvement horizon represents a ~$16b addressable market, expanding TPW’s TAM to ~$35b (incl. B2C ~$16b / B2B >$3b / Home Improvement ~$16b), whilst also being counter cyclical to the housing market (moving vs renovating).

- Net cash ~$105.5m; we believe bolt-on acquisition(s) could be on the cards in CY2022: Net cash of $105.5m (vs end-FY21 $97.5m), provides ample capacity to make bolt-on acquisitions, such as in digital capability, product range, brand awareness, or to accelerate growth in TPW’s B2B / Home Improvement offerings.

Investment view: Upgrade from Hold to Buy, PT $12.10

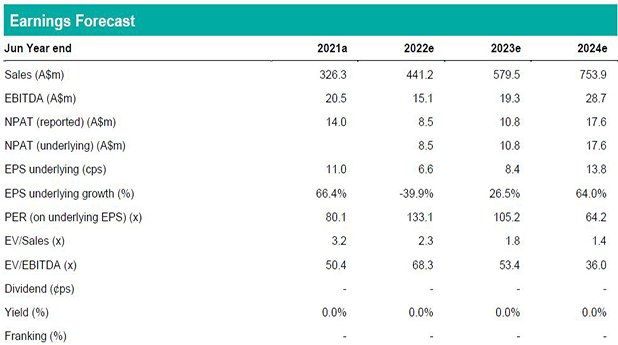

We have moderated our revenue growth forecasts as conservative measure in a rising interest rate environment, although we are yet to allow for upside from TPW’s Home Improvement offering. The net effect is our PT reduces to $12.10 (previously $12.75). Following TPW’s share price retreat, we believe valuation is now more appealing with FY23e EV/sales ~1.8x. Also, TPW’s new growth horizons (B2B / Home Improvement), the structural shift to online plus M&A prospects, provide attractive offsetting benefits vs potential risks from the housing cycle. Accordingly, we upgrade from Hold to Buy.