Record first quarter, ~10% ahead of expectations

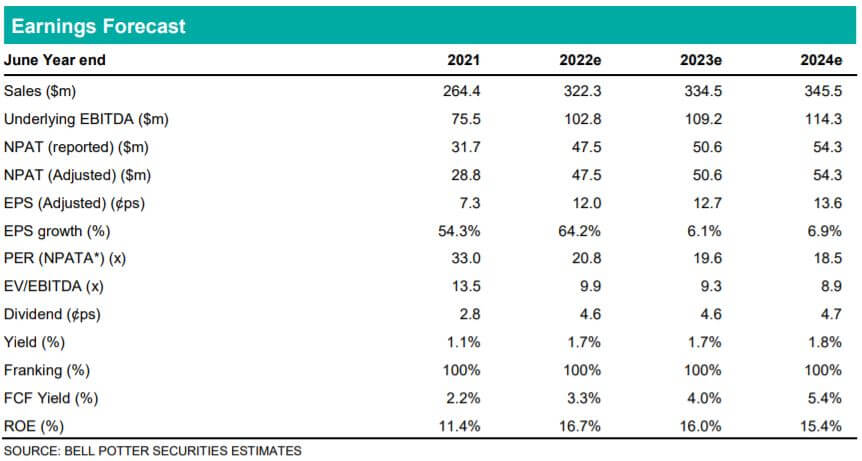

IMD has released a record 1Q22 trading update, with unaudited revenue 13% QoQ (41% YoY) to $86.8m. The result was driven by relatively even growth in all regions, and was ~10% ahead of our expectations (BPe 1Q22e $79.2m). We have increased our FY22e revenue estimates 6.9% to $322.3m and our EBITDA 8.3% to $102.8m accounting for the result, although further upside is likely given the following:

Upside to conservative seasonality assumptions: We assume 2Q22e and 3Q22e decline by -15% versus 1Q22, relating to the Northern Hemisphere winter. Historically seasonality is between -5-15%, and we have assumed the bottom end of the range.

Upside to growth assumptions: In a growing market, we would expect 4Q22e to be larger than 1Q22, although we assume a -2.7% decline at this early stage.

Upside to margins: The contribution margin to EBITDA per incremental dollar of revenue was 58.9% in 2H21, versus our assumption of just 42.7% in FY22e. We see potential for operating leverage to exceed our expectations, in line with 2H21.

Accelerating BLASTDOG development

We have updated for the $20m acquisition ($8m cash | $12 deferred scrip) of cloudbased geological data modelling and visualisation technology software. The transaction is not expected to be EPS accretive until FY24e, although we see strategic value given the: (1) capacity to complement and accelerate BLASTDOG development; (2) additional software expertise to supplement IMDEXHUB and aiSIRUS developers; and, (3) potential to extend software to use cases/tools beyond BLASTDOG.

Investment view: Retain Buy recommendation:

We increase our Underlying EPS estimates by +13.0%, +6.9% and +2.9% for FY22e, FY23e and FY24e respectively, accounting for the strong 1Q21 and slightly higher costs due to MinePortal. We continue to see a strong outlook for FY22e revenue growth and margin expansion, while the resumption of trials and new JDAs provides a free option on ongoing technology development (particularly BlastDog). We reiterate our Buy recommendation and raise our Price Target to $3.00ps (previously $2.85ps).