Could Bega pass up buying back Bega?

Fonterra (FSF) recently highlighted a desire to focus on its NZ milk business, with a decision to be made on the ownership structure of the Australian business. In this note we explore a potential acquisition of Fonterra Australia (Fonterra) by Bega.

Fonterra background: In FY21 Fonterra Australia generated revenues of ~A$1.8Bn, EBIT of ~A$69m and estimated EBITDA of ~A$97m. The business collected 1.4BnL of milk, primarily in VIC & TAS, with milk supply having fallen ~30% since FY18.

Synergies could be material: We estimate potential synergies of $35-45m in putting the two businesses together. Synergies would be expected in the area of: removal of duplicate corporate support and marketing functions; consolidation of cut, wrap and shred operations; and consolidation of cold chain distribution.

Bega brand ownership: Fonterra licenses the Bega trademark for use in various cheese products from BGA in Australia and pays an annual royalty for this. The initial 25yr term concludes in 2026, although Fonterra has renewal rights. The potential presence of change in control provisions around the licensing agreement may present an issue for any potential bidder outside of BGA.

ACCC issues: Two assets stand out as having the potential to draw a review, being Stanhope and Cobden. Our analysis of the competitive landscape in both catchments suggests Cobden is likely more of an issue, but not central to a BGA acquisition case.

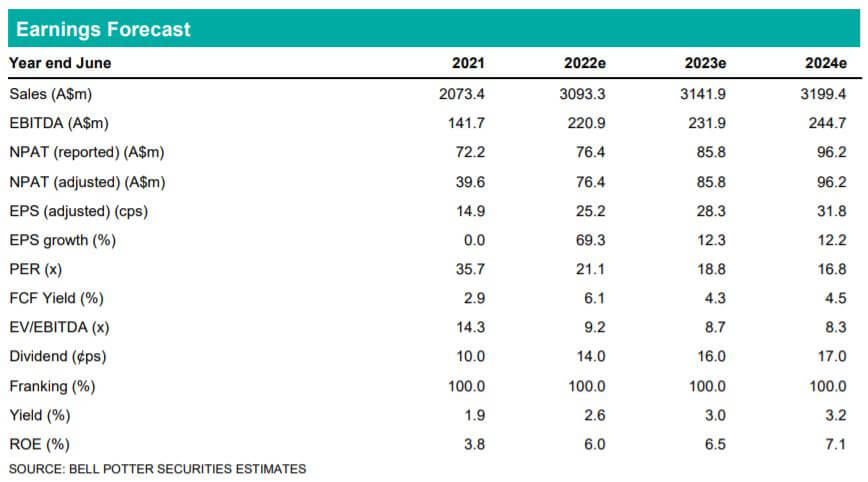

EPS Accretion/dilution: Assuming BGA acquired Fonterra at a multiple comparable to past transactions (13-15x EBITDA) and extracted the midpoint of our synergy range, then we estimate such a transaction has the scope to be double digit EPS accretive.

Investment view: Buy rating unchanged

Bega has a strategy to own iconic brands and the opportunity to repatriate the Bega brand, while adding Western Star would have to be compelling. New equity would be required to fund such a move, however, the recent removal of BGA’s 15% shareholder cap paves the way for FSF to retain a cornerstone stake, potentially reducing external capital needs. Our Buy rating and $6.35ps target price are unchanged.