Leverage to long duration themes

Coventry Group (CYG) is a multi-disciplinary industrial supply and services group primarily engaged in the distribution of industrial fasteners and specialist building supplies, as well as the design and servicing of fluid power systems in mining equipment. Our investment thesis is driven by (1) a superior service model in industry verticals where skills and critical spares are in short supply; (2) leverage to two long duration themes, including the industry shift to re-shore supply chains (commercial construction), along with ageing fleets and increasing strip ratios (mining equipment repairs); (3) margin upside from mix dynamics and fixed cost leverage; (4) a five-year period of winning market share in fluid systems; and (5) an undemanding valuation.

A compelling industrial turnaround

For an extended period (pre-FY17) Coventry shed material market share in its core Australian distribution business principally, in our view, due to customer service deficiencies. Since FY17, new management has driven a +$23.1m (pre-AASB 16 EBITDA) industrial turnaround led by a refocus on its agile ‘one-stop-shop’ fasteners supply program – a service type that has supported a decade of category leadership and near class-leading margins in New Zealand and Tasmania. Coventry’s step-up during 2H21 has accelerated further into Q1 FY22, implying that losses in the broader Australian market are beginning to be recouped at pace and, importantly, little cost to gross margin. We now see scope for this to begin reflecting further in the share price.

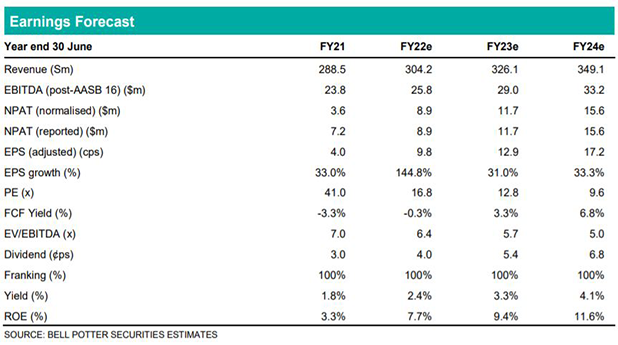

Scope to re-rate: Buy and $1.90ps price target

We initiate coverage on Coventry with a Buy recommendation and PT of $1.90ps. We see CYG’s mid-term execution risk as now noticeably reduced: the company’s revamped service-intense model is well suited to provide efficiencies and superior customer outcomes in a tightening market, whilst pent-up sector demand is expected to result in an extended cycle for building materials. In our view, Coventry’s forward EV/EBITDA of 6.4x and 2.4% dividend yield presents compelling value for a company that has the potential to enter an earnings upgrade cycle, and possibly re-rate.