Expecting $5.83bn cash profit, 70¢ final dividend

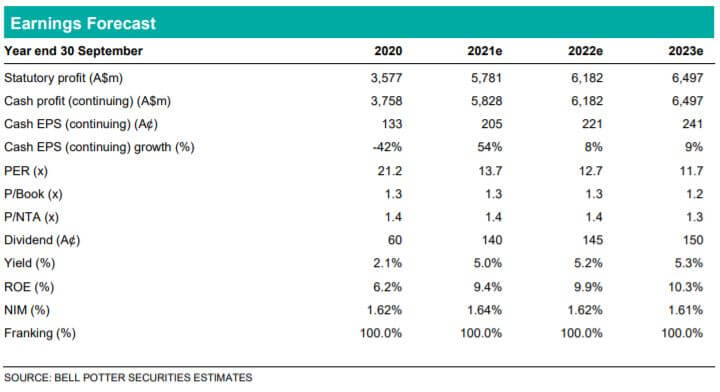

ANZ’s result will come out on Thursday 28 October 2021 and our FY21 forecasts are: 1) statutory profit $5.78bn; 2) cash profit $5.82bn; 3) cash profit (continuing) $5.83bn; 4) cash EPS (continuing) 205¢; 5) final dividend 70¢ fully franked, 2H21 payout ratio 70% (42% in 2H20); 6) cash ROE (continuing) 9.4%; 7) group NIM (continuing) 1.64%; 8) credit impairment charge -$0.42bn/-7bp GLA ($2.74bn/44bp in FY20); 9) CIR (continuing) 52%; and 10) Level 2 CET1 ratio 12.0%.

Overall changes include lower net interest income (2% lower, mainly due to lower volumes and despite a 1bp increase in NIM in 2H21 from good NIM management) and lower other banking income (18% lower mainly from institutional banking although there was a gain of around 12% in 2H21) offset by lower operating expenses (the bank continues to manage costs relatively well, down from $4.78bn in 2H20 to $4.48bn in 1H21 and a forecast of $4.23bn in 2H21) plus a benefit in credit impairment charge in the first half of $0.49bn and back to an expense of $74m in 2H21 (as the industry further normalises). We expect CIR (continuing) to land at 52% in FY21 (51% in 2H21 vs. 53% in 1H21).

Price target $31.00, Buy rating unchanged

While we have made no changes in net interest and other operating income, we have decided to: (1) further lower operating expenses by $130m in FY21 and a similar amount in FY22, to arrive at an overall CIR of around 44% at the end of FY23 and FY24; and (2) increase the credit impairment charge by another $200m but only in FY22. The net impact on cash profit (continuing) is as follows: (1) FY21 +2%; (2) FY22 +1%; (3) FY23 nil; and (4) FY24 +3%. The theoretical composite valuation is marginally increased by around $1.00 to $31.33, thanks to higher DCF and dividend yield (sustainable). Nevertheless, we have left the price target unchanged at $31.00 being the mid-point of the value range of $30.36-31.33. Based on this price target and 12-month TSR in excess of 15%, we maintain a Buy rating on ANZ.