Order book continues to fill, further opportunities remain

GNG has announced a ~$68m contract award for works at Newmont Corporation’s Tanami gold mine. Works have been subcontracted to GNG by RUC Cementation Mining Contractors Pty Ltd, and are expected to be completed by April 2023.

Additionally, we note positive project updates from ASX-listed Galena Mining on its Abra Base Metals Project, and Geopacific Resources on its Woodlark Gold Project. GNG was previously awarded a $74m conditional EPC contract in February 2020 for the Abra Base Metals Project, whilst GNG has previously valued the Woodlark opportunity at $92m. With these projects continuing to progress, formal contract confirmation and construction ramp up would further strengthen GNG’s order book.

Outlook remains strong, potential upside for UPS

GNG’s workload continues to be supported by high commodity prices, which are increasing access to capital, and project activity amongst its key junior/mid-tier resources clients. In addition to the ~$68m Tanami contract, GNG has recently announced a $75.5m contract from Calidus Resources for its Warrawoona Gold project, and a $59.5m contract from Pantoro for its Norseman Gold project.

Additionally, we note that the Australian Government has opened expressions of interest for Phase 1 of the Northern Endeavour decommissioning works. Potential awards under this decommissioning process for GNG’s UPS Oil & Gas subsidiary would represent upside to our forecasts.

Buy rating maintained, price target increased to $1.70

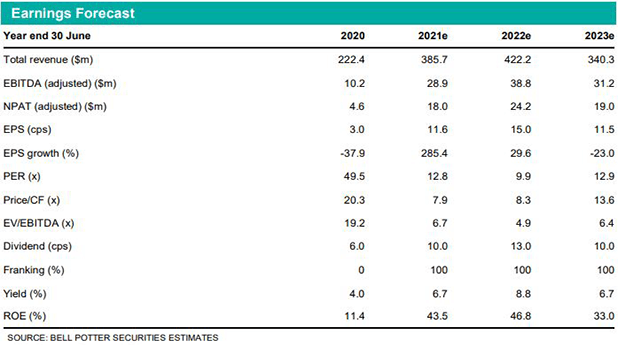

Our FY22e and FY23e EPS forecasts are raised by 2.8% and 4.6% respectively. We have also increased our FY22e and FY23e dividend estimates by 8.3% and 11.1% respectively. Our FY21 estimates are unchanged. We continue to remain attracted to GNG’s exposure to Australian resources projects, with a solid net cash position and forecast fully-franked dividend of 8.8% in FY22e, further supporting our Buy rating.