FACTORING IN ALTERNATIVE MARKET EXPOSURES

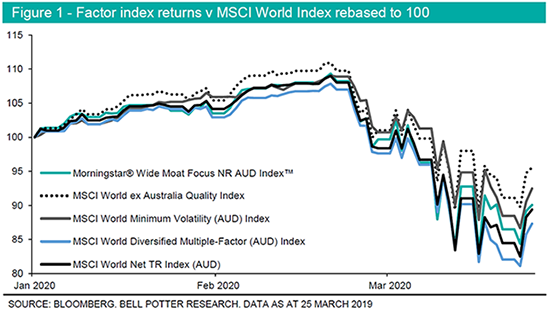

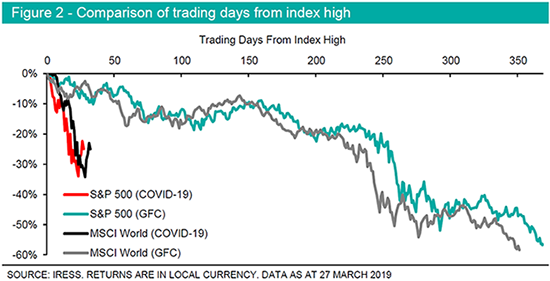

In the space of a month, the MSCI World Index (in USD) had been sold-off by over 30%. The modern world is experiencing an unprecedented systematic shutdown of borders and businesses, suppressing the outlook of future economic global growth.

Confidence has been diminished and uncertainty remains high as the world awaits a return to normality. It is, however, certain that the bottom of the market cycle will be unknown until it has come and gone. Dollar-cost averaging is one strategy at this time to buy into the market whilst reducing the risk of further sudden falls in asset prices. An alternative strategy is investing in factor-based ETFs, also known as Smart Beta ETFs, to gain a tilted exposure to the global equity market. Whilst traditional ETFs track a market-cap weighted index, a factor-based ETF applies a rules-based investing approach.

The factor-based ETFs explored in this report are aimed at providing a defensive tilt to long global equities. These factors include companies that are included into a portfolio due to high quality scores based on key fundamental factors, minimum volatility strategies that aim to decrease less than the broad market during downturns and strategies that incorporate multiple-factors to reduce intra-portfolio correlation.

Each ETF offers the ability to stay invested through various market conditions.

GLOBAL QUALITY FACTOR ETFS

BetaShares Global Quality Leaders ETF (QLTY)

- Index: iSTOXX MUTB Global Ex-Australia Quality Leaders Index

- Management costs (p.a.): 0.35%

- Holdings: ~150

- Unit price: $18.00

- Market capitalisation: $41.1m

SPDR MSCI World Quality Mix Fund (QMIX)

- Index: iMSCI World Factor Mix A-Series Index

- Management costs (p.a.): 0.40%

- Holdings: ~782

- Unit price: $19.68

- Market capitalisation: $20.9m

VanEck Vectors MSCI World ex Australia Quality ETF (QUAL)

- Index: MSCI World ex Australia Quality Index

- Management costs (p.a.): 0.40%

- Holdings: ~300

- Unit price: $20.08

- Market capitalisation: $858.9m

VanEck Vectors MSCI World ex Australia Quality (A$ Hedged) ETF (QHAL)

- Index: MSCI World ex Australia Quality 100% Hedged to AUD Index

- Management costs (p.a.): 0.43%

- Holdings: ~300

- Unit price: $23.92

- Market capitalisation: $34.0m

GLOBAL MINIMUM VOLATILITY FACTOR ETFS

Vanguard Global Minimum Volatility Active ETF (Managed Fund) (VMIN)

- Index: FTSE Global All Cap Index (AUD hedged)

- Management costs (p.a.): 0.28%

- Holdings: ~261

- Unit price: $45.12

- Market capitalisation: $14.6m

iShares Edge MSCI World Minimum Volatility ETF (WVOL)

- Index: MSCI World Minimum Volatility (AUD) Index

- Management costs (p.a.): 0.30%

- Holdings: ~459

- Unit price: $30.80

- Market capitalisation: $129.7m

GLOBAL MULTI-FACTOR ETFS

VanEck Vectors Morningstar Wide Moat ETF (MOAT)

- Index: Morningstar Wide Moat Focus Net Return AUD Index

- Management costs (p.a.): 0.49%

- Holdings: ~48

- Unit price: $68.15

- Market capitalisation: $152.3m

Vanguard Global Multi-Factor Active ETF (Managed Fund) (VGMF)

- Index: FTSE Developed All-Cap in Australian dollars Index

- Management costs (p.a.): 0.34%

- Holdings: ~907

- Unit price: $41.25

- Market capitalisation: $14.1m

iShares Edge MSCI World Multi-Factor ETF (VDMF)

- Index: MSCI World Diversified Multiple-Factor (AUD) Index

- Management costs (p.a.): 0.35%

- Holdings: ~333

- Unit price: $29.29

- Market capitalisation: $218.2m

GLOBAL VALUE FACTOR ETFS

Vanguard Global Value Equity Active ETF (Managed Fund) (VVLU)

- Index: FTSE Developed All-Cap in Australian dollars Index

- Management costs (p.a.): 0.28%

- Holdings: ~1273

- Unit price: $34.50

- Market capitalisation: $17.7m