As part of the Federal Governments $66 billion stimulus package to help reduce the economic fallout of the coronavirus, on Sunday Treasurer Josh Frydenberg made the following three announcements:

EARLY ACCESS TO SUPERANNUATION

Superannuation members in financial hardship will be able to withdraw $10,000 tax-free from their superannuation this financial year (2019-2020) and next financial year (2020-2021).

As the existing rules for early release under Financial Hardship or Compassionate Grounds are quite narrow, the Government has announced this temporary extension to take into account the large economic impact of COVID-19.

To apply for the early release of funds from superannuation a member must satisfy at least one of the following requirements:

- They are unemployed.

- They are eligible to receive a job seeker payment, youth allowance for jobseekers, parenting payment (which includes the single and partnered payments), special

benefit or farm household allowance; or - On or after 1 January 2020

- Were made redundant, or

- Had their working hours reduced by 20% or more, or

- For sole traders, their business was suspended or there was a reduction in their turnover of 20% or more.

There is no income or asset test, the payment will not affect Centrelink or Veterans’ Affairs payments and only one payment will be permitted each financial year. Applications will be accepted from mid-April 2020.

A non-SMSF member is able to apply via their MyGov account. The ATO will assess the application and provide both the member and superannuation their determination. The fund will then make the payment.

For SMSF applicants, the process is likely to be largely the same however the ATO will release further guidance on its website in due course.

The impact of this measure on large superannuation funds is yet to be known. Clearly those with members in high-risk jobs such as retail, casual employment etc will have a great number of members wishing to take advantage of these withdrawals. Unfortunately, they will come at a time where asset values have reduced for the member and the fund is already struggling with liquidity due to a large move to cash.

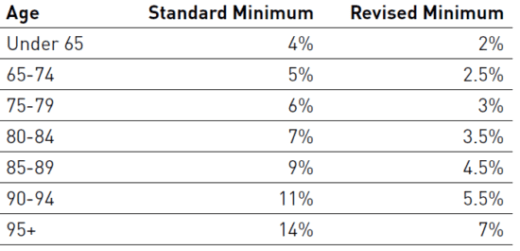

REDUCTION IN THE MINIMUM PENSION

Members drawing an Account Based Pension must draw a legislative minimum each financial year. This minimum is based on the members age and the Account Based Pension balance on 1 July each financial year. This minimum starts at 4% for those under age 65, 5% from 65 – 74, etc.

The Government has temporarily halved this minimum pension required for the 2019-2020 and 2020-2021 financial year to minimise the likelihood that members would have to sell assets in a depressed market if they did not have enough available cash. This is a similar method employed by the Government during the Global Financial Crisis.

The revised minimums are as follows:

If a member has already drawn their minimum or above, they will not be permitted to recontribute the excess unless they meet the age and balance requirements for contributions.

If a member would like to take advantage of the revised minimum they should contact their superannuation fund to turn off or adjust the automatic payments.

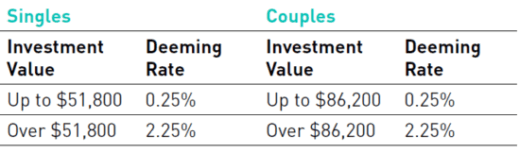

REDUCTION IN DEEMING RATES

The Government will reduce the pensioner deeming rates for financial investments from 1 May 2020 by a further 0.25%. Deeming rates are not directly linked to the RBA cash rate, however this change will likely be as a result of the Reserve Banks latest interest rate cut.

This change will benefit around 900,000 income support recipients including primarily Age Pensioners.

The deeming rates will be as follows:

No action will be required to be taken by the pensioner. These new deeming rates will automatically be applied on 1 May 2020.

CONCLUSION

If you would like to take advantage of these measures please contact your adviser.