Iron ore stronger for longer – but still set to drop

We have updated our commodity price and foreign exchange rate forecasts, including the mark-to-market for FY21 of our benchmark iron ore price. For the June 2021 quarter we measured the 62% Fe benchmark price at US$200.40/dmt which was 5.5% ahead of our US$190dmt forecast. We continue to see downside risk to the iron ore price as a result of lower Chinese steel production, increased iron ore production, the ongoing disruption of COVID-19 and maintain our forecast for it to drop in 1HFY22. However, the price has remained stronger than expected and we reflect this into FY22 and FY23, with increases of 9% (to US$143/dmt) and 5% (to US$100/dmt) respectively. We also continue to forecast a lower AUD:USD exchange rate, which we view is consistent with a dropping iron ore price, global interest rate differentials and Australia’s (relatively) lagging COVID-19 vaccinisation rates.

Record dividend, bumper yields

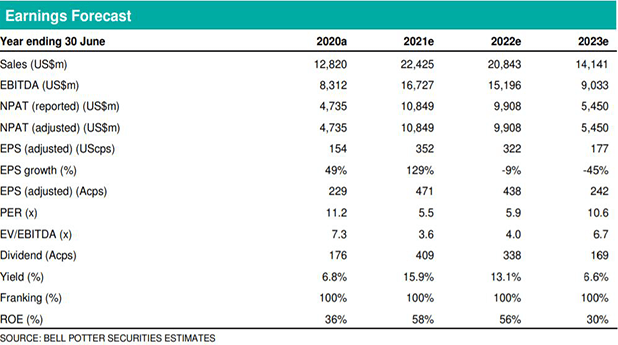

These updates have a positive impact on our financial forecasts for FMG. Our key focus in the near term remains the dividend payout and yield. Our FY21 dividend increases 1.3% to A409cps, inclusive of a fully franked final dividend payment of A262cps (from A257cps), a 10.2% yield on its own. Our forecast prospective 12-month dividend payouts lift 5.7% to A460cps (from A435cps) as 1HFY22 captures our higher iron ore price forecast, for an interim payment of A198cps and forecast 17.9% fullyfranked yield. In our view FMG’s fully franked dividend yields remain a key price support for the stock, even in our forecast environment of a declining iron ore price.

Investment thesis – Hold TP$24.06/sh (from Hold, $23.96/sh)

Our NPV-based target price increases incrementally to $24.06/sh and our FY21 and FY22 earnings forecasts increase 1% and 12% respectively on this update. The dividend remains a compelling price support, offsetting the recent share price appreciation to maintain a forecast total shareholder return of 11.4%. We retain our Hold recommendation, in conformity with our recommendation structure.