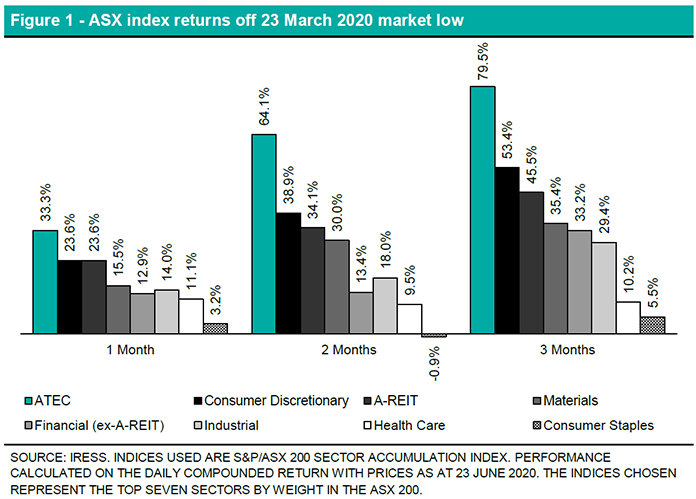

BetaShares S&P/ASX Australian Technology ETF (ATEC), which provides exposure to a range of tech-related market segments, listed on 5 March 2020 before falling nearly 40% to a low on 23 March. ATEC has rallied ~80% in the 3 months since the market bottomed, largely due to Afterpay Limited (APT) and its increase of ~560% over this period. APT has grown to be the largest holding in ATEC with a weight of 15.5% as at 23 June. ATEC increased the units outstanding by ~155% during May and is likely to see further strong inflows as investors seek growth that has been underrepresented in the broad market domestic ETFs.

Recently Listed ASX ETFs

AIRLIE AUSTRALIAN SHARE FUND (MANAGED FUND) (AASF)

AASF aims to provide investors with access to a concentrated a ‘best-ideas’ portfolio of 15-35 (typically ~25) quality Australian listed companies. The portfolio is managed by Magellan Asset Management Limited trading as Airlie Funds Management and led by Portfolio Managers Matt Williams and Emma Fisher. The Manager is an active long-only, bottom-up specialist.

Investment objective

The Fund’s primary objective is to provide long-term capital growth and regular income through

investment in Australian equities.

Investment approach

Airlie employs a prudent, common-sense investment approach that identifies companies based

on their financial strength, attractive durable business characteristics and the quality of their

management teams. Airlie invests in these companies when their view of their fair value

exceeds the prevailing market price.

iSHARES CORE CORPORATE BOND ETF (ICOR)

ICOR aims to provide investors with the performance of the Bloomberg AusBond Credit 0+ Yr Index (before fees and expenses). The index is designed to measure the performance of the Australian corporate bond market and includes investment grade fixed income securities issued corporate entities.

Investment objective

BlackRock believes that stratified sampling is the most appropriate investment strategy to track the performance of the Index as it takes into account liquidity, transaction cost impact, and overall risk relative to the Index. This involves choosing a subset of Index eligible securities to create a portfolio that behaves like the Index. In many cases, holding every security in the Index is not cost effective as illiquid or thinly traded securities incur higher transaction costs and wider bid-ask spreads. BlackRock will also apply ESG screens to remove companies involved in controversial weapons, fossil fuels, tobacco, civilian firearms and UN compact violators.

Investment approach

The Index is market value weighted and designed to measure the total return from investing in a range of Index eligible securities, selected based on a minimum quality standard, a minimum issue size of A$100m, have at least 1 month to maturity, and denominated in Australian dollars. The Index rebalances on a monthly basis, with the rebalance day being the last calendar day of the month. The Index may undergo periodic unscheduled rebalances at other times.

iSHARES YIELD PLUS ETF (IYLD)

IYLD aims to provide investors with the performance of the Bloomberg AusBond Credit and Fixed Rate Note Ex-Big 4 Banks Index (before fees and expenses). The index is designed to measure the performance of the Australian corporate bond market (excluding issuers ANZ, CBA, NAB and WBC).

Investment objective

BlackRock believes that stratified sampling is the most appropriate investment strategy to track the performance of the Index as it takes into account liquidity, transaction cost impact, and overall risk relative to the Index. This involves choosing a subset of Index eligible securities to create a portfolio that behaves like the Index. In many cases, holding every security in the Index is not cost effective as illiquid or thinly traded securities incur higher transaction costs and wider bid-ask spreads. BlackRock will also apply ESG screens to remove companies involved in controversial weapons, fossil fuels, tobacco, civilian firearms and UN compact violators.

Investment approach

The Index comprises a broad range of investment grade corporate bonds which meet certain investment criteria and cover fixed interest securities issued in the Australian debt market under Australian law. The Index is market value weighted and designed to measure the total return from investing in a range of Index eligible securities. Eligible securities are selected based on a minimum quality standard, a minimum issue size of A$100m, amongst other criteria The Index rebalances on a monthly basis.

iSHARES YIELD PLUS ETF (IYLD)

IYLD aims to provide investors with the performance of the Bloomberg AusBond Credit and Fixed Rate Note Ex-Big 4 Banks Index (before fees and expenses). The index is designed to measure the performance of the Australian corporate bond market (excluding issuers ANZ, CBA, NAB and WBC).

Investment objective

BlackRock believes that stratified sampling is the most appropriate investment strategy to track the performance of the Index as it takes into account liquidity, transaction cost impact, and overall risk relative to the Index. This involves choosing a subset of Index eligible securities to create a portfolio that behaves like the Index. In many cases, holding every security in the Index is not cost effective as illiquid or thinly traded securities incur higher transaction costs and wider bid-ask spreads. BlackRock will also apply ESG screens to remove companies involved in controversial weapons, fossil fuels, tobacco, civilian firearms and UN compact violators.

Investment approach

The Index comprises a broad range of investment grade corporate bonds which meet certain investment criteria and cover fixed interest securities issued in the Australian debt market under Australian law. The Index is market value weighted and designed to measure the total return from investing in a range of Index eligible securities. Eligible securities are selected based on a minimum quality standard, a minimum issue size of A$100m, amongst other criteria The Index rebalances on a monthly basis.

Domestic Equity ETFs

The rebound in domestic equities continued in May as the All Ordinaries rose towards 6,000. Whilst the increase in the ASX All Ordinaries Accumulation Index and the S&P/ASX 200 Accumulation Index was not as substantial as previous month, they returned a solid 5.0% and 4.4%, respectively. Small caps again outperformed the larger cap securities in the market recovery with the S&P/ASX Small Ordinaries Accumulation Index returning 10.6%. The top performing market cap mandated domestic ETF was the Vanguard MSCI Australian Small Companies Index ETF (VSO) which holds approximately 173 securities with a median market cap of $2.46bn. VSO returned 11.5% in May after returning 16.5% in April.

BetaShares S&P/ASX Australian Technology ETF (ATEC) was again the top performing domestic equity ETF. After returning 22.0% in April, ATEC added 14.6% in May. ATEC experienced a ~155% increase in the units outstanding as it continues to grow with the ongoing demand for Australian technology exposure. ATEC’s core sector exposure towards Information Technology and Communication only make up approximately 3.5% and 4.2% of the ASX 200 index, respectively. As at 23 June, ATEC includes 50 securities with the largest weighting towards Afterpay Limited (APT) and Xero Limited (XRO).

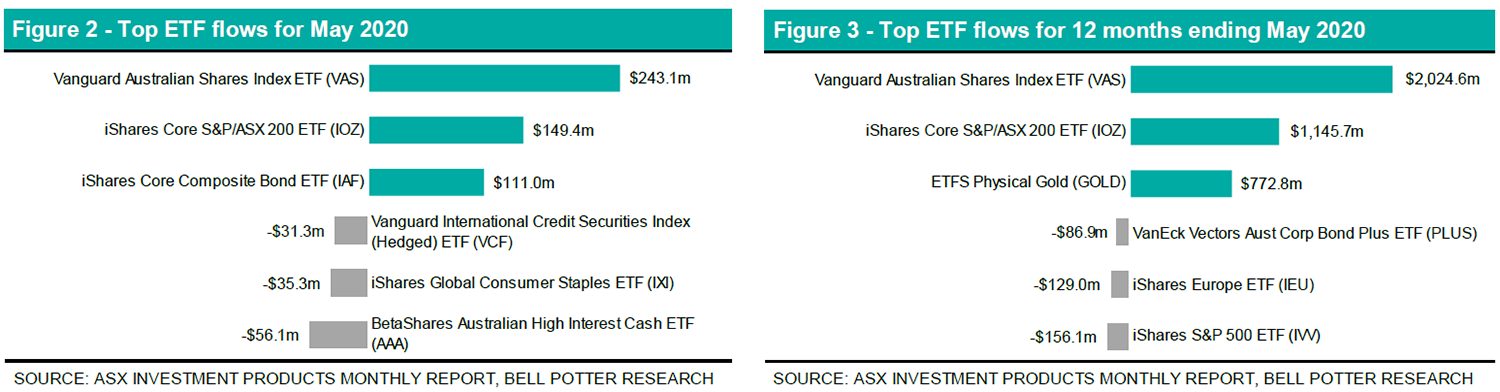

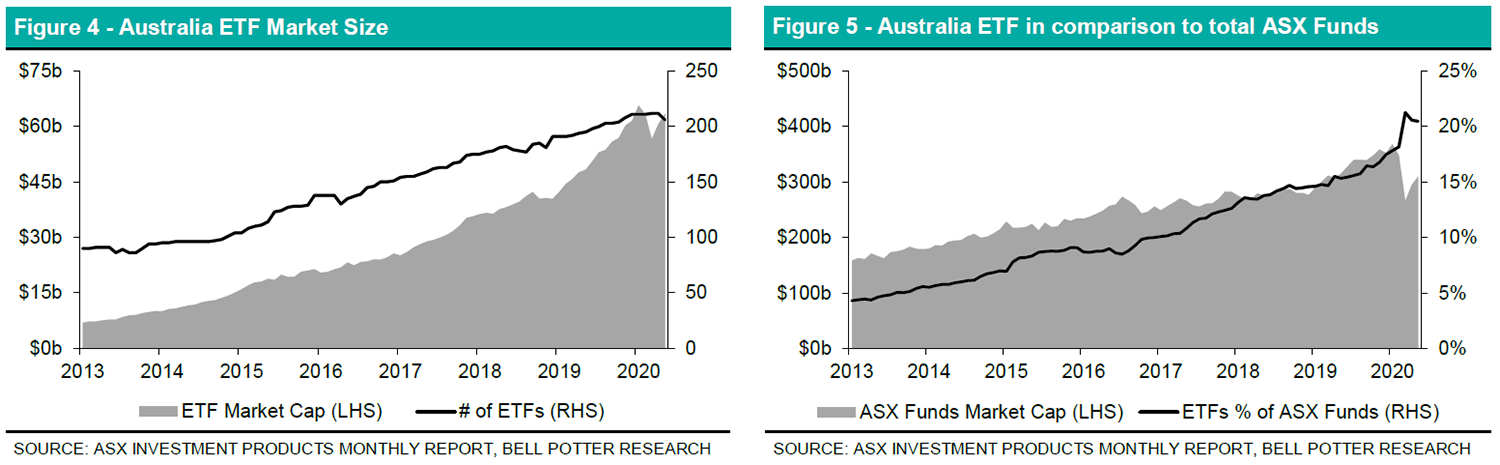

Vanguard Australian Shares Index ETF (VAS) and iShares Core S&P/ASX 200 ETF (IOZ) received the largest net fund inflows over the month with $243m and $149m, respectively. The total of $808m net inflows into domestic equity ETFs was an increase of ~$80m over the previous month. Total FUM is now back above the February 2020 closing level, held up by the strong level of inflows into domestic ETFs even as volatility rose and equities were sold off.

BetaShares S&P/ASX 200 Resources Sector ETF (QRE) had net outflows of ~$29m during the month. The outflow resulted in decrease of 42.7% in the units outstanding. QRE aims to track the performance of the Solactive Australia Resources Sector Index (before fees and expenses). The Index provides exposure to the biggest companies in Australia’s resources sector, with BHP Group Limited (BHP) the largest holding at 33.5% as at 23 June.

Global Equity ETFs

Net inflows of ~$604m into global equity ETFs were record in May, as the total FUM climbs back towards the month-end high in January 2020. Morningstar International Shares Active ETF (MSTR) recorded the highest net inflows with ~$80m. MSTR is an exchange traded managed fund (Active ETF) that primarily invests into the Morningstar International Shares (Hedged) Fund. MSTR aims to be diversified across international companies that exhibit fundamental quality and/or value characteristics.

BlackRock products led the global net outflows with iShares Global Consumer Staples ETF (IXI) recording net outflows of ~$35m for the month, which equates to a 20% decrease in the units outstanding. iShares S&P 500 AUD Hedged ETF (IHVV) and iShares MSCI Japan ETF (IJP) recorded net outflows of ~$20m and ~$12m, respectively.

The top performing ETF in the month was BetaShares Global Cybersecurity ETF (HACK), returning 12.3%. HACK aims to track the performance of the Nasdaq Consumer Technology Association Cybersecurity Index (before fees and expenses). The Index includes companies engaged in the cybersecurity segment of the technology and industrial sectors. The companies included are primarily involved in the building, implementation, and management of security protocols applied to private and public networks, computers, and mobile devices to provide protection of the integrity of data and network operations. The portfolio is heavily weighted towards the United States with a ~87% weight at the end of May 2020. Top holdings include CrowdStrike Holdings Inc (CRWD.NASDAQ) and Broadcom Inc (AVGO.NASDAQ) with 7.0% and 6.3% as at 23 June, respectively.

Outside of BetaShares U.S. Equities Strong Bear Hedge Fund – Currency Hedged (BBUS) which returned -12.2%, the lowest performing global equity ETF in May was ETFS Reliance India Nifty 50 ETF (NDIA). NDIA returned -4.8% for the month and has returned -20.7% year -to-date.

Fixed Interest ETFs

Domestic fixed interest ETFs returned to positive net inflows with $134m entering the segment for the month. This was led by iShares Core Composite Bond ETF (IAF) with net inflows of $111m. IAF aims to provide investors with the performance of the Bloomberg AusBond Composite 0+ Yr Index (before fees and expenses). After leading net inflows in the previous month, BetaShares Australian High Interest Cash ETF (AAA) recorded net outflows of ~$56m in May.

Global fixed interest ETFs recorded the third consecutive month of net outflows, albeit by reducing amounts. Vanguard International Credit Securities Index (Hedged) ETF (VCF) recorded net outflows of $31m.

Commodity & Currency ETFs

Net inflows to Commodities have been decreasing over the past quarter, with $142m recorded in May. Gold mandates continue to receive the bulk of the inflows and led by ETFS Physical Gold (GOLD) with ~$773m over the past 12 months, including $77.5m in May. Investors continue to speculate on a recovery in the WTI crude oil price by investing in BetaShares Crude Oil Index ETF – Currency Hedged (Synthetic) (OOO). After changing the investment mandate to add further protection from the volatility of the futures price of WTI crude oil, OOO has effectively become an actively managed fund. Caution should be taken by investors seeking to gain exposure to a potential rebound in the price of oil. The futures exposure that OOO aims to provide to unitholders is now at the discretion of the fund provider until further notice.

Currency ETF flows and trading was scarce as per usual.