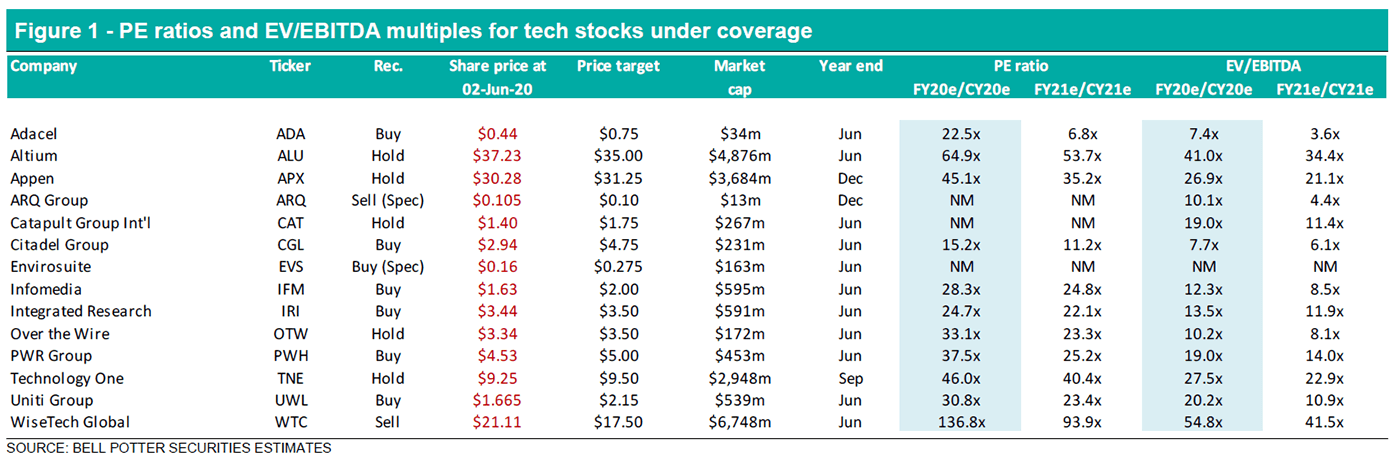

Our updated key picks in the tech sector following some material price movements and changes in our recommendations are:

- Uniti Group (UWL): Moves up to our number one pick following the downgrade in recommendation to HOLD for our previous number one pick – Appen – and given we still see good value in Uniti with also the chance of an upgrade to FY20 guidance or at least a result at the upper end of the existing guidance range;

- Infomedia (IFM): A new key pick following the recent upgrade in our recommendation to BUY given the underperformance of the stock relative to most large cap stocks, the limited downside risk we see to the FY20 guidance and also the likelihood that acquisitions will occur in the coming months; and

- PWR Group (PWH): Another new key pick given the value we see in the stock – FY21 PE ratio of c.25x – and the potential of an unusually strong FY21 result with the traditionally weaker first half to be boosted by a greater number of races (e.g. F1) due to the late commencement of elite motorsports this year.

The key changes we have made to our key picks since we last updated them in late April are to remove Appen (APX) and Catapult Group (CAT) given the downgrade in recommendation for both to HOLD and to replace these with Infomedia and PWR Group. The only other notable change is Uniti has moved up from number two to our number one pick.

Updated key sells: WTC

Our updated key sells are now just WiseTech Group (WTC) given the ARQ Group (ARQ) share price is now around our valuation (though we still have a SELL (Speculative) recommendation on the stock). The SELL on WiseTech is based on valuation and our view the FY20 result will be towards the lower end of the revenue and EBITDA guidance ranges.

Key Picks

Uniti Group (BUY, PT $2.15)

Uniti is a key pick for the following key reasons:

- High level of recurring revenue: Around 90% of Uniti’s revenue is recurring which compares favourably to its closest comp, Opticomm (OPC), which only has around 60% recurring revenue. The key difference between the two is Opticomm generates a much higher percentage of revenue from construction and connections than Uniti. The businesses of Uniti are also highly cash generative and, for instance, free cash flow in 2HFY20 is forecast to be around 70% or more of EBITDA.

- Beneficiary of current environment: Uniti is a beneficiary of the shift to working from home and the associated increase in residential demand for high speed broadband services. Evidence of this was the company had a record number of net new FTTP (fibre-to-the-premise) connections in March 2020. Even as restrictions ease and there is a shift back to the office we expect residential demand to remain strong given the likely desire to have the option of working from home.

- Potential of an upgrade: Uniti has guidance of underling EBITDA (which excludes transaction costs and share-based payments) of b/w $17.5-18.5m and also a 2HFY20 exit run rate for underlying EBITDA of b/w $38-40m. The company said in its Appendix 4C for the March quarter that all three businesses performed ahead of expectations in the quarter and the annualised run rate EBITDA at 31 March was above forecast. This suggests the company is tracking at least towards the upper end of the guidance and may even upgrade the guidance some time this month.

- Looks reasonable value: Uniti is trading on an FY21 EV/EBITDA multiple of just under 11x which we believe looks reasonable value both in an absolute sense and relative to Opticomm which is trading on an FY21 EV/EBITDA multiple of just over 11x. In our view the two should trade on a similar multiple given the close similarities between the two and the higher recurring revenue/better free cash flow of Uniti is probably offset by the longer pipeline of Opticomm as well as the higher barriers to entry.

Overall view: Uniti is one of the few stocks in the telco/tech space that still looks reasonable value in our view and is also the only stock where we see the potential of an upgrade to guidance. Even if there is no upgrade, we would expect a result towards the upper end of guidance which should still be well received. The other potential catalyst for the stock is that acquisitions may resume again after a bit of a hiatus.

Infomedia (BUY, PT $2.00)

Infomedia is a key pick for the following key reasons:

- Limited downside risk to guidance: Infomedia reaffirmed its FY20 guidance when it announced a capital raising in late April and also provided ranges for both expected revenue ($93-95m) and NPAT ($18-19m). We see limited downside risk to the guidance given the recent affirmation, the high level of recurring revenue (c.95%), the low customer contract concentration risk and the globally diversified earnings and operations.

- Financial pressure on customers is lessening: The lockdown restrictions applied globally over the past few months caused some of Infomedia’s customers – automotive dealerships – to ask for a discount on their monthly subscriptions and in most cases this was provided (though it was not significant enough to be material or prevent reiteration of the guidance). Now that the lockdown restrictions are being eased globally we expect less financial pressure on the dealerships and less need for discounting going forward.

- Acquisitions are likely nearing: Infomedia recently raised a total of c.$84m in order to “accelerate its expanding pipeline of acquisition opportunities and to further invest in its core product and service offerings.” We expect the first one or two acquisitions to occur in the coming months and believe these may provide a catalyst for the share price. Note we do not expect every acquisition announced to be EPS accretive but we do expect each to provide a complementary offering to Infomedia’s current portfolio.

- Underperformance relative to large cap tech: Infomedia has underperformed relative to most large cap tech stocks over the past several weeks and we attribute this to the capital raising – which was done without an acquisition – and more generally to a market preference towards large caps. We do, however, expect this underperformance to reverse in the coming weeks or months given the likelihood of an acquisition or two and assuming the market remains robust which will likely cause some shift in preference towards mid caps in the search for value.

Overall view: Infomedia is a high quality business and has proven to be resilient with the recent reiteration of its FY20 guidance but we attribute the recent underperformance mostly to the recent capital raising which was done without an accompanying acquisition. We expect this to change, however, in the coming months when the company announces the first of potentially several acquisitions and this in our view will help drive a re-rating of the share price, especially if the first or second acquisitions are of decent size and profitable.

PWR Group (BUY, PT $5.00)

PWR is a key pick for the following key reasons:

- Tide is turning: PWR has been negatively impacted in 2HFY20 from the cessation of elite motorsports globally, the shutdown of most OE programs and to a lesser extent softness in the automotive aftermarket. As a result we have had to downgrade our FY20 NPAT forecast by around 25%. The good news, however, is that elite motorsports and OE programs are now recommencing and the automotive aftermarket is recovering so the worst now appears to be past for the company.

- Strong outlook for FY21: The outlook for FY21 is positive with the recommencement of elite motorsports and OE programs but it could be a particularly strong year if there is as many races as is currently planned to occur in 1HFY21. The first half for PWR is traditionally weak given a large portion of the manufacturing for elite motorsports happens in the second half but if there is an unusually high number of races in 1HFY21 then this could lead to a relatively strong first half result and set the foundation for a particularly strong full year result.

- News flow should be positive: The key to a strong 1HFY21 and FY21 result will be a high number of races in 1HFY21 and a relatively quick return to pre-COVID production levels for OE programs. There will be plenty of news flow in both these areas and, assuming both are achieved, the news flow should be generally positive which will provide a good read through for the 1HFY21 and FY21 results as well potential catalysts for the share price.

- Looks reasonable value: In our view PWR looks reasonable value on an FY21 PE ratio of c.25x considering the strong double digit earnings growth we growth for the next few years. We also believe there is some upside potential to our FY21 forecast – which would lower the PE ratio – depending on how many races are conducted in 1HFY21 and how quickly OE programs return to normal production levels.

Overall view: PWR has been hit hard in 2HFY20 by COVID-19 due to it being a manufacturer and having a relatively high fixed cost base but on the flip side the impact on 1HFY21 could be equally positive if elite motorsports try and complete a large portion of their seasons this year in the next six months. The key question is whether the market will look through the 2HFY20 and FY20 result but in our view it will, especially if the company indicates at the release of the result in August that demand is strong and capacity is improving month-to-month.

Key Sells

WiseTech Global (SELL, PT $17.50)

WiseTech is a key sell for the following key reasons:

- Valuation: We have high regard for WiseTech as a company and its SaaS operating model. We recognise its leading global market position and believe the medium to long term outlook is positive for the stock due to its SaaS platform and integrated modules which sets it apart from its competitors. The key issue we have, however, is valuation and we regard an FY21 PE ratio of >90x as excessive particularly when we forecast negative underlying EPS growth in FY20.

- Expecting low end of guidance: WiseTech has FY20 guidance of revenue b/w $420-450m and EBITDA b/w $114-132m and the company reaffirmed this guidance in late April as well as late May. We, however, expect the company to report towards the low end of both ranges and forecast revenue and EBITDA of $423m and $118m. We do not, therefore, expect the FY20 result to be a positive catalyst for the share price.

- Further likely reductions in contingent liabilities: WiseTech recently announced it had renegotiated the earn outs on 17 of its past acquisitions and the result was $147m reduction in contingent liabilities through the issue of $81.5m in equity and a $69.5m reduction in fair value. The company also said it expects to renegotiate the earn outs on most of the other acquisitions in the coming months and we expect a similar result with some reduction in contingent liabilities. The market reaction to the first announcement was negative and, assuming there is another reduction in earn outs, we expect the reaction to the next announcement to also be negative.

- Potential write down of goodwill: The reduction in contingent liabilities just mentioned did not result in any write down of goodwill but rather resulted in a fair value gain in the P&L. The reduction in earn outs does suggest, however, the acquisitions are not performing as well as expected so this also suggests the goodwill may not be justified and needs to be written down. The company said it does not anticipate any write down of goodwill but we do not rule it out with the upcoming audit of the FY20 result.

Overall view: The key driver of our SELL recommendation on WiseTech is valuation but we also see potential negative catalysts of an FY20 result towards the low end of the guidance ranges and also another reduction in earn outs on past acquisitions. The other key focus in the coming months will be the FY21 guidance and we already forecast a strong rebound so the risk on this is probably more to the downside than the upside.