CY23 result in line; CY24 production guidance falls short

CRN reported NPAT of US$156m (BP est. US$152m) and underlying EBITDA of US$382m. A net cash position of US$97m and available liquidity of US$489m were reported at last month’s December 2023 quarterly release. A final dividend of US$0.005/sh was declared, in line with its biannual fixed dividend policy.

Initial CY24 guidance issued: CRN is guiding to saleable production of 16.4-17.2Mt (CY23 15.8Mt); mining costs of US$95-99/t (CY23 US$108/t); and capital expenditure of US$220-250m (CY23 US$228m). We had expected stronger production guidance (~18Mt) given significant investment in Curragh’s waste movement over CY22-23; and the commencement of mining at Buchanan’s Southern District, which is believed to host more favourable geological conditions compared with the North.

20.5Mtpa production target on track for mid-2025

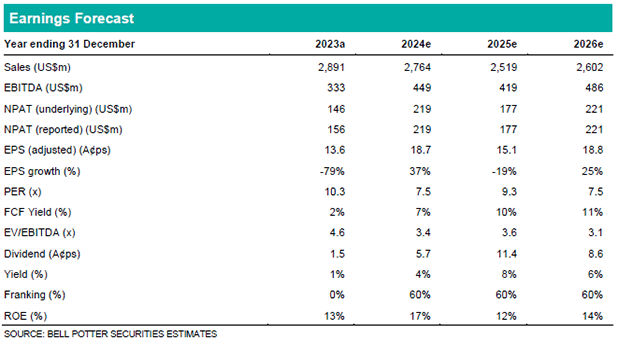

From late 2024, the Curragh Underground Project is expected to provide an additional 1.5-2.0Mtpa saleable production at a capital cost of US$105m. At Buchanan, supplementary hoisting and storage capacity is on schedule for completion in mid- 2025. CRN remain on target for 20.5Mtpa saleable production from mid-2025, which should support more consistent free cash generation and shareholder returns. We forecast dividend yields of 4%, 8% and 6% in years CY24-26, respectively.

EPS changes as in this update include: CY24 -44%; CY25 -32%; and CY26 -3%. We have marginally lowered our production estimates and increased our unit cost assumptions in CY24 and CY25, consistent with the broader industry landscape.

Investment view – Buy, Target Price $1.85/sh (prev. $1.95/sh)

Our Buy recommendation reflects our positive met coal price outlook (supply constrained). Throughout 2024, CRN should realise production and cost benefits from its self-funded organic growth investment across its Australian and US operations, supporting consistent free cash generation and shareholder returns. We still see the potential for CRN to participate in industry consolidation.