CY23 financial result

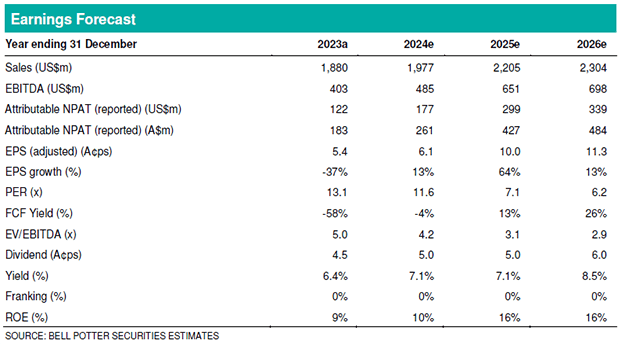

NIC reported a CY23 financial result which was slightly ahead of our forecasts at the EBITDA line but a miss at the NPAT lines due to higher D&A, withholding tax and finance expenses. The result reflected record production and good cost control in an environment of materially lower nickel prices and higher input costs. Nickel tonnes sold increased by 90% but sales revenue was up just 54%. EBITDA increased by 21% and EBITDA margins dropped from 29% to 21% in a tough nickel market. Key metrics included consolidated revenue of US$1,880m (vs BPe US$1,852m), consolidated EBITDA of US$403m (vs BPe US$395m), consolidated NPAT of US$176m (vs BPe US$213m) and attributable NPAT of US$122m (vs BPe US$153m).

Making money through the cycle

The highlight of the result, in our view, is the maintenance of profitability and good EBITDA margins through a low in the commodity price cycle. This is due to NIC’s low-cost operations, its diversified product mix and exposure across the nickel production value chain. NIC is accelerating its transition to the production of class 1 nickel as it invests in the Huayue (HNC) and Excelsior (ENC) Nickel Cobalt high pressure acid leach (HPAL) projects. These produce nickel at carbon intensities among the lowest in the industry and suitable for supply to the EV battery market. An increased dividend and US$100m share buyback (announced with the December quarterly) were also highlights, signalling there is no requirement to issue equity in the foreseeable future.

Investment thesis – Buy, TP$1.53/sh (unchanged)

EPS changes in this report are: CY24: +1%; CY25: +3%; and CY26: +3%, on minor adjustments to our financial cost forecasts and calculation methodology. Our NPV-based valuation is unchanged at $1.53/sh. NIC is trading on undemanding valuation multiples, offers a supportive (unfranked) dividend, has demonstrated its ability to make money through the nickel price cycle and is one of the world’s only listed nickel producer that offers diversified exposure across nickel products and markets. We retain our Buy recommendation.